Apartments.com Rent Report for March 2025: Rent Prices Plateau, but Changes Are Expected

Key Takeaways:

- The national average rent in March was $1,575 per month, which is a year-over-year increase of 1.1%.

- Omaha is experiencing significant rent increases, driven by a strong job market and limited new construction, with rent prices expected to rise 4.1% by the end of the year.

- The Midwest and Northeast are seeing increased job growth and higher rents, while the Sun Belt continues to see rent prices fall due to oversupply and reduced demand.

- A shifting job market could impact rent prices, as job growth declines in the South and grows in the Northeast.

In March, the national average rent was $1,575 per month for a one-bedroom apartment and $1,835 for a two-bedroom. The year-over-year increase of 1.1% is virtually unchanged from not only last month, but almost all of 2024.

The vacancy rate remains at 8.1%, staying roughly the same since it fell from 8.6% in November 2024. But while rent prices and vacancy rates seem to have stalled, demand for apartments has increased. This, combined with fewer new apartments coming onto market, could signal that rent prices will begin to climb in the coming months.

While March showed more of the same, some interesting trends are developing in unexpected markets. The Midwest as a whole has seen rent prices climbing, but one city stands out: Omaha, Nebraska.

What’s Happening in Omaha?

While Omaha didn’t rank among the top five cities for March, its rent prices have climbed 3.6% year-over-year. This rise is striking considering that it never surpassed the average US rent growth in the decade prior to the pandemic. So, what’s happening in Omaha?

Omaha’s rental market has experienced a significant shift since the pandemic. Over the past three years, average rent in the city has risen by 4.6% annually, outpacing the national average. This increase stems from a robust job market driving demand for housing while new construction lags behind. Omaha’s apartment vacancy rate sits at 6.3%, well below the national rate.

Omaha’s rent prices are expected to increase 4.1% by the end of the year, putting Omaha on track to become one of the top 10 US cities with the highest rent increases.

Compare this to cities in the Sun Belt, particularly Austin, Texas. For the past 10 months, Austin’s rent prices have tumbled, down -4.5% year-over-year. The construction of new apartment buildings, started during the pandemic to answer rising demand, have come on market as that demand has decreased, leaving Austin with a vacancy rate of 14.8%.

Shifts in the Job Market

In the five years since the pandemic, job growth patterns have begun to shift. This factors into why the Midwest and Northeast are seeing lower vacancy rates and higher rent prices. From 2020 to 2025, the South accounted for 62.9% of total job growth. Compare this to the West at 22.4%, the Midwest at 7.7%, and the Northeast at 7%.

Over the past year, things have started to change. The South is still the clear leader, but the region’s share of job growth has shrunk to 49.2%. The Northeast, which saw the slowest rate of job growth in the years immediately after the pandemic, has seen its rate more than double to 21.9%. The Midwest also saw an increase in job growth, up to 12.1%. As for the West, it saw job growth decline to 16.8%.

This shift is most evident in New York City, which added around 153,000 jobs last year, helping the city recover from pandemic-era losses. New York’s rent prices are up 0.9% to an average of $3,926 per month, which is 149% higher than the national average. The city’s vacancy rate of 2.8% makes it one of the most competitive markets in the US.

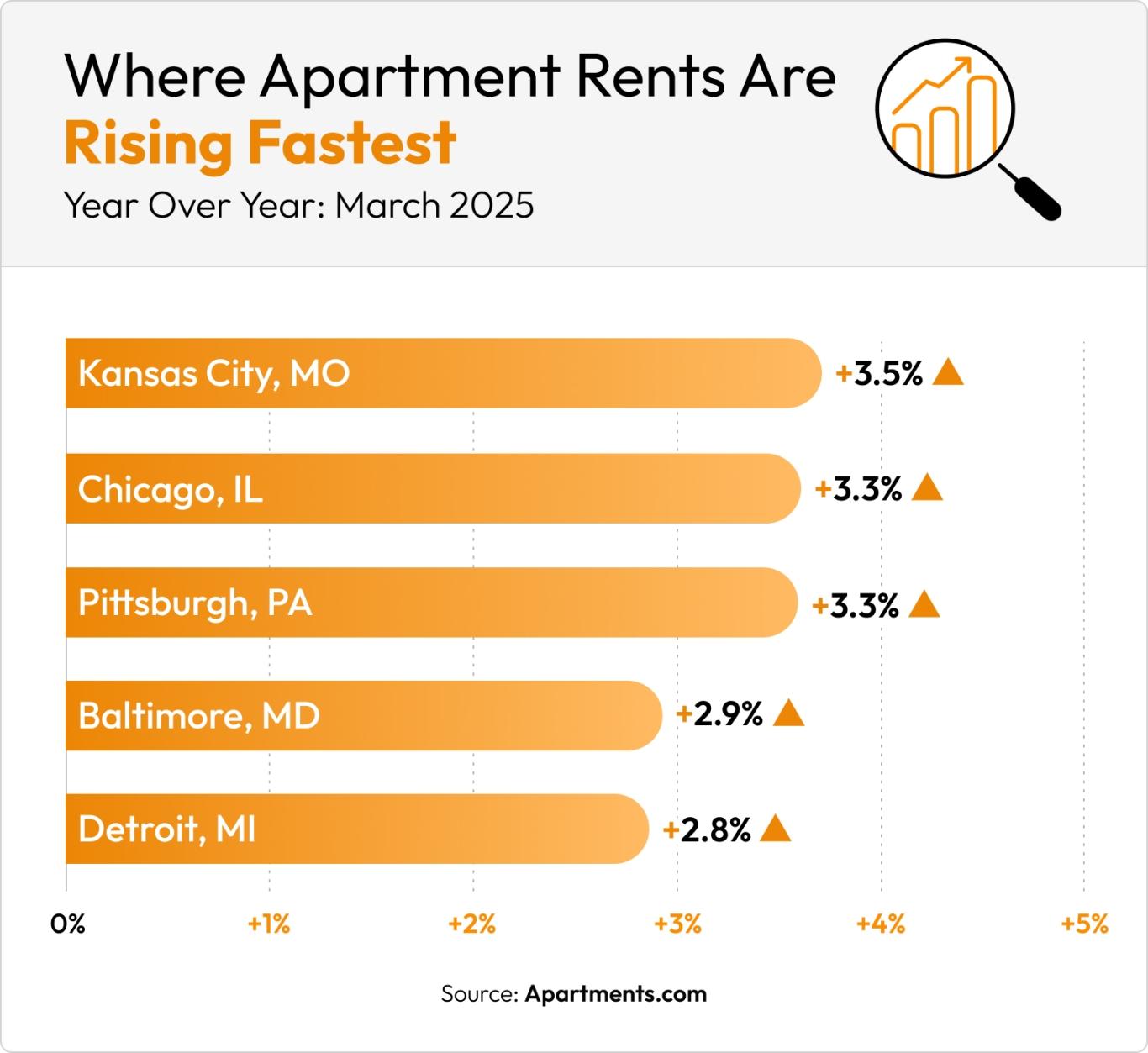

Cities with the Biggest Rent Increases

In February, Rochester, NY and Grand Rapids, MI topped the list of cities with the largest rent increases. Providence, RI; Omaha, NE; and Dayton, OH rounded out the list, which was very similar to January’s top five. For March, none of those cities made it into the top five. Instead, there’s a new leader emerging for highest rent increase: Kansas City.

For March 2025, here are the cities with biggest rent increases:

- Kansas City, MO (+3.5%)

- Chicago, IL (+3.3%)

- Pittsburgh, PA (+3.3%)

- Baltimore, MD (+2.9%)

- Detroit, MI (+2.8%)

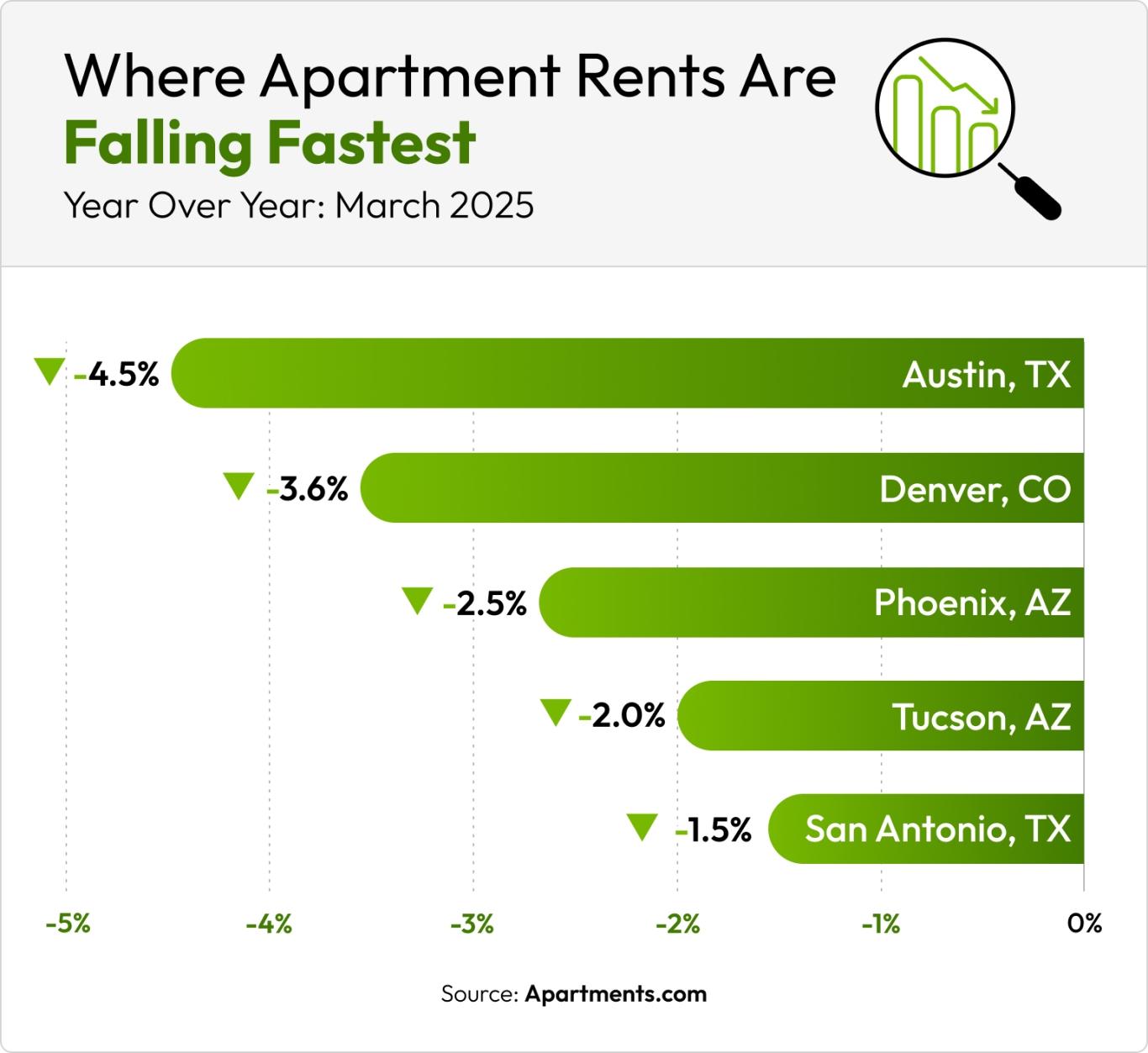

Cities with the Biggest Rent Declines

For the last 10 months, Austin has topped the list of the cities with the largest rent declines. Austin’s average rent is currently $1,437 per month, which is -4.3% lower than the national average. Last month, Austin was followed by Denver at -3.4%. Denver is second again, with a slightly larger decrease in rent prices.

For March 2025, here are the five cities with the biggest rent declines:

- Austin, TX (-4.5%)

- Denver, CO (-3.6%)

- Phoenix, AZ (-2.5%)

- Tucson, AZ (-2.0%)

- San Antonio, TX (-1.5%)

Current Rent Prices Across the US

|

City |

Current Average Rent |

Last Month’s Average Rent |

Year-Over-Year Difference |

|

$2,390 |

$2,387 |

+1.6% |

|

|

$1,606 |

$1,602 |

-1.6% |

|

|

$1,438 |

$1,437 |

-4.3% |

|

|

$3,444 |

$3,427 |

-0.6% |

|

|

$1,628 |

$1,628 |

+0.6% |

|

|

$2,857 |

$2,864 |

+1.2% |

|

|

$1,788 |

$1,787 |

-1.6% |

|

|

$1,484 |

$1,486 |

-1.5% |

|

|

$1,916 |

$1,900 |

+3.2% |

|

|

$1,096 |

$1,094 |

+0.4% |

|

|

$1,299 |

$1,299 |

-3.5% |

|

|

$1,147 |

$1,147 |

+0.4% |

|

|

$1,415 |

$1,409 |

-1.2% |

|

|

$1,656 |

$1,653 |

-4.8% |

|

|

$2,236 |

$2,234 |

+1.2% |

|

|

$1,281 |

$1,281 |

-0.7% |

|

|

$3,762 |

$3,774 |

+2.6% |

|

|

$1,688 |

$1,673 |

+0.9% |

|

|

$1,200 |

$1,199 |

-0.2% |

|

|

$1,120 |

$1,109 |

+2.2% |

|

|

$2,870 |

$2,877 |

-0.9% |

|

|

$1,318 |

$1,317 |

-0.8% |

|

|

$3,179 |

$3,161 |

+1.4% |

|

|

$1,190 |

$1,182 |

+0.7% |

|

|

$1,306 |

$1,307 |

-0.6% |

|

|

$1,782 |

$1,767 |

-0.2% |

|

|

$2,165 |

$2,166 |

-0.7% |

|

|

$1,457 |

$1,440 |

+2.2% |

|

|

$2,160 |

$2,161 |

+0.9% |

|

|

$1,169 |

$1,160 |

+1.1% |

|

|

$1,366 |

$1,363 |

+0.1% |

|

|

$1,702 |

$1,682 |

-1.3% |

|

|

$3,931 |

$3,935 |

+1% |

|

|

$1,589 |

$1,587 |

-1.1% |

|

|

$1,734 |

$1,717 |

-0.5% |

|

|

$1,338 |

$1,335 |

-2.5% |

|

|

$1,343 |

$1,332 |

+1% |

|

|

$1,512 |

$1,507 |

-1.1% |

|

|

$3,270 |

$3,267 |

+2% |

|

|

$1,393 |

$1,371 |

-1.2% |

|

|

$1,392 |

$1,385 |

+0.4% |

|

|

$1,563 |

$1,553 |

+0.5% |

|

|

$1,107 |

$1,106 |

+0.7% |

|

|

$1,109 |

$1,105 |

-1.7% |

|

|

$2,347 |

$2,346 |

-0.3% |

|

|

$2,993 |

$2,969 |

+2.8% |

|

|

$2,610 |

$2,598 |

+0.8% |

|

|

$2,081 |

$2,071 |

+0.4% |

|

|

$1,665 |

$1,658 |

+0.6% |

|

|

$2,302 |

$2,307 |

+0.3% |

How Current Rent Prices Impact Renters

While rent prices are stable right now, shifts can happen quickly. Staying informed about rent prices in your area can help you make important decisions about moving, renewing a lease, or negotiating rent.

For renters in cities like Omaha and Kansas City, moving could prove challenging. With higher rent prices and lower vacancy rates, you could find that you must pay more or compete with other renters for available units.

On the other hand, if you’re hoping to move to a city that’s experiencing lower rent prices and higher vacancy rates, like Austin, you could find it much easier to negotiate and get concessions like reduced deposits or a free month of rent.

In addition to rent prices and vacancy rates, it’s important to consider an area’s cost of living. While Omaha’s rent prices are leading the way in increases, the city’s cost of living is still -7.4% lower than the national average, with the average rent falling between $942 and $1,671. Compare that to New York, where the overall cost of living is 129.6% higher than the national average, with average rents between $3,171 and $6,590.

If you’re planning to move to a different state, knowing current rent trends and using tools like the Cost of Living Calculator can help you determine how much money you’ll need to live comfortably in your new home.

Learn more about what you can expect by comparing the rent prices from this report to those from January and February to determine the overall trend and visit the US Rent Trends page to view the most current rent prices available across the US.

Methodology:

The rent data in this report is sourced from CoStar Group’s Market Trend reports. CoStar group is the leading authority in commercial real estate information, analytics, and news, trusted by real estate professionals for more than 37 years. By combining this data with Apartments.com internal data and public record, we’re able to deliver the most up-to-date rental information available.

To determine overall rent trends, we evaluate rent prices from more than 2,400 cities across the nation, including the top 80 national markets. This analysis includes year-over-year and month-over-month rent changes to provide a comprehensive view of market dynamics. This report covers a diverse range of property types to ensure a holistic view of the rental market.

FAQs

What is the average rent in the US right now?

The average rent as of March 2025 is $1,576 per month, which is an increase of 1% over last year.

Which states had the largest rent increases in March 2025?

The states with the largest increases in March 2025 are Kansas, Nebraska, and Virginia. Nebraska rent prices are up 3.8% year-over-year, averaging $1,075 per month. Kansas is seeing rent prices that are 4.4% higher than last year, while Virginia rent prices have increased by 3.7%.

Which states have the cheapest rent right now?

Right now, the states with the lowest rent prices are Oklahoma, West Virginia, and Arkansas. The lowest rent prices in the US can be found in Oklahoma, where the average rent is $895 per month. This is 43.21% lower than the national average.

Are rent prices rising or falling in the US?

The average rent price in the US is up by 1% year-over-year.