Multifamily performance in the first quarter of 2024 revealed a mixed picture, with rising demand and absorption still outpaced by excess supply. Driven by the varied supply-and-demand dynamics across the country, regional differences persist. The Midwest and Northeast, where development has been limited, continue to drive rent growth, while rent growth in the oversupplied Sun Belt remains in negative territory.

National market sees weak rent growth, even with rising demand

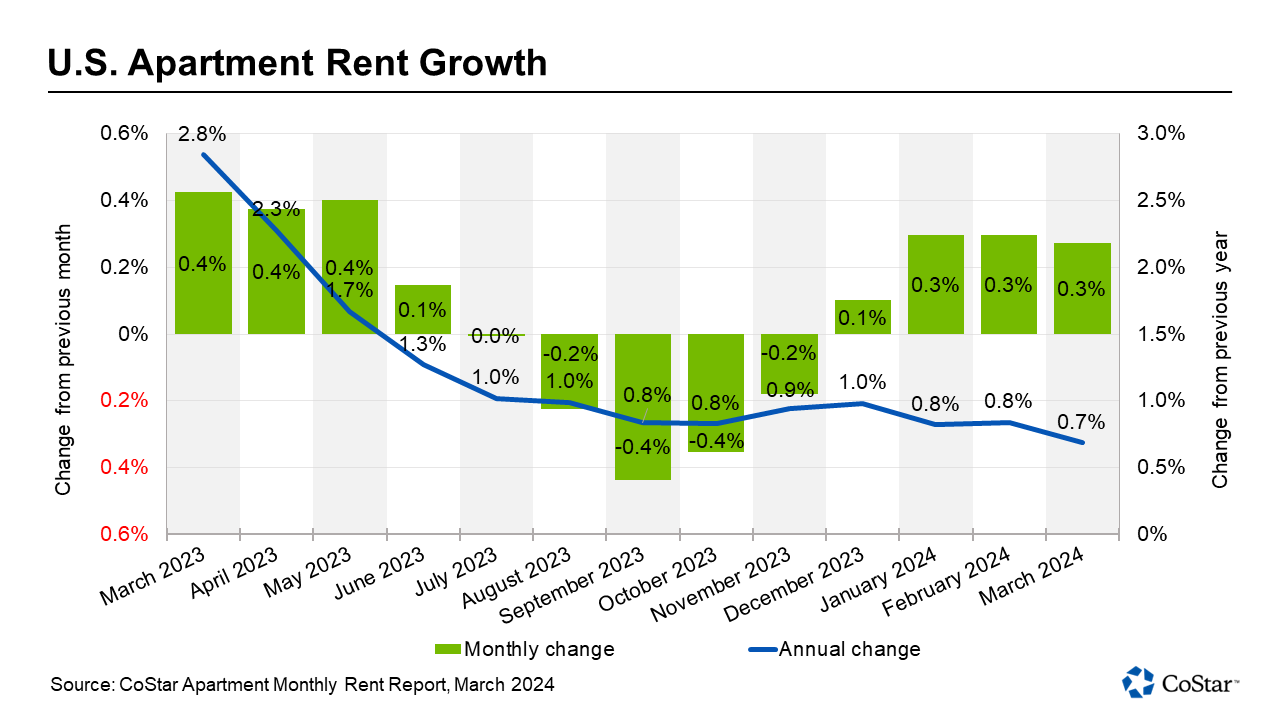

Rent growth retreated slightly in the first quarter of 2024, according to the latest CoStar data. A rebound in demand wasn’t enough to overcome the elevated supply. The imbalance with supply — which remains at near historic highs — continues to suppress rent growth, which averaged 0.7 percent nationwide.

Year-over-year growth in asking rent slowed in the first quarter to 0.7 percent. This is the 10th consecutive quarter in which supply has outpaced demand, and rent growth has continued to hover near 1 percent since the middle of 2023.

At 104,000 units, national absorption totals were the highest seen since the third quarter of 2021.

The vacancy rate rose slightly, from 7.7% in December 2023 to 7.8% in March 2024. This marked the slowest vacancy increase in the last 10 quarters, an important slowdown in what had been the steepest incline of the past two decades.

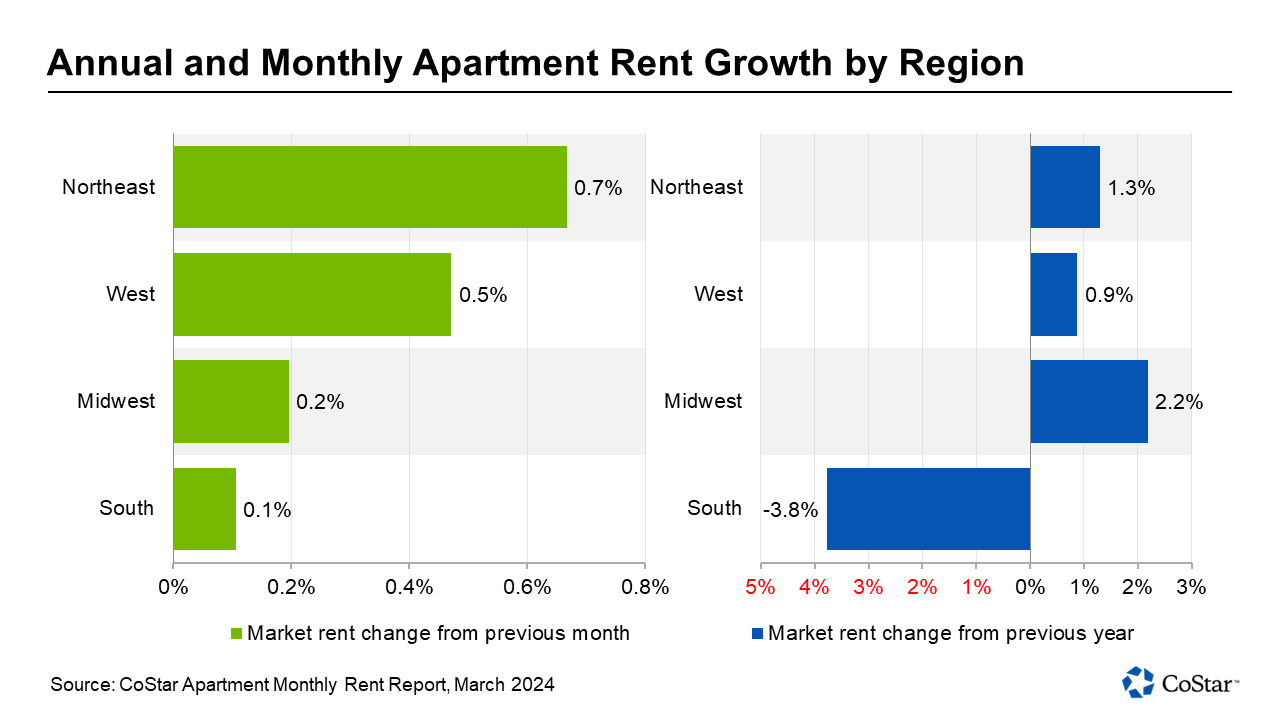

Midwest and Northeast lead nation in rent growth

At the regional level, the Midwest and Northeast have continued to outperform the rest of the country, while the South struggles with negative rent growth. In the Midwest, year-over-year asking rents grew by 2.2 percent, the highest rate in the country, while the Northeast saw growth of 1.3 percent. At 0.9 percent, rent growth in the West barely exceeded the national average of 0.7 percent. And in the South, growth fell by 3.8 percent.

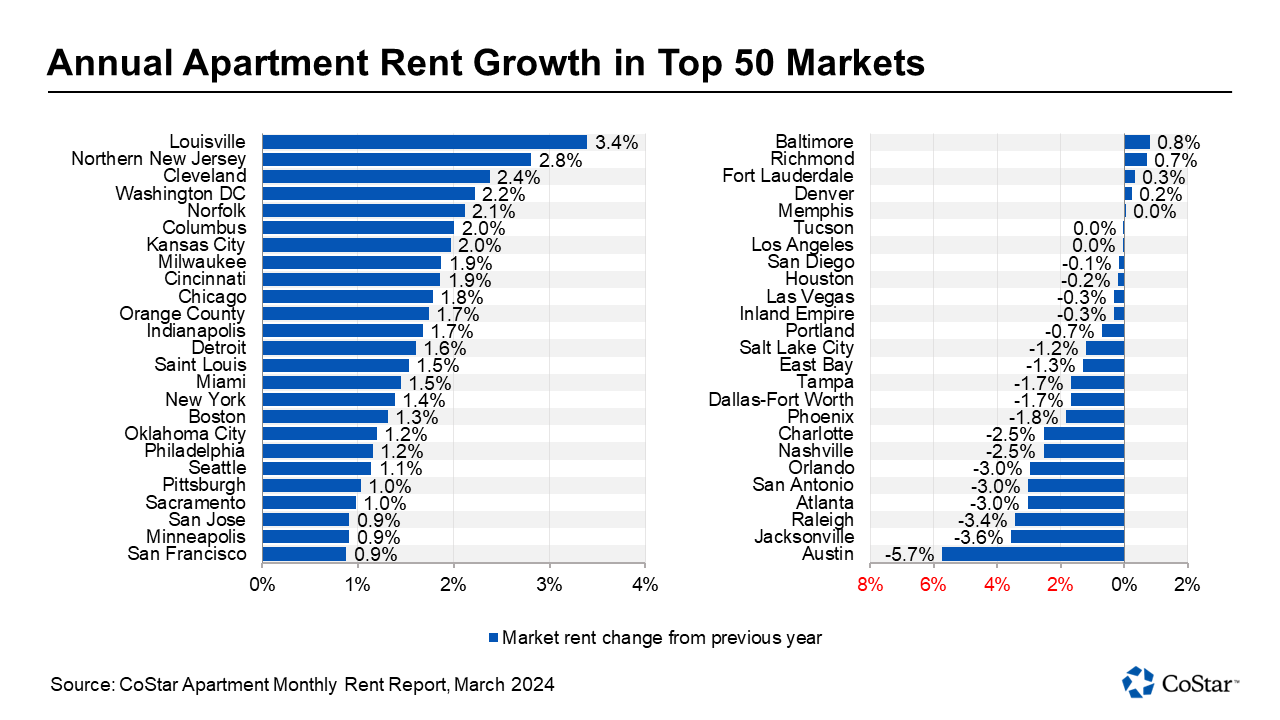

The Austin multifamily market saw the largest drop in rent growth, while Louisville surged ahead, reflecting regional trends between the Sun Belt and Midwest.

The top performing markets for rent growth are found in a geographically concentrated area encompassing much of the Midwest, as well as states straddling the Southern border and parts of the Mid-Atlantic region.

Bottom performers for rent growth were all in the Sun Belt, ranging from Phoenix in the Southwest, across Texas, to several metros in the Southeast. The most dramatic drop was 5.7 percent in Austin.

Top 10 markets for year-over-year rent growth

- Louisville, KY

- Northern New Jersey, NJ

- Cleveland, OH

- Washington, D.C.

- Norfolk, VA

- Columbus, OH

- Kansas City, MO

- Milwaukee, WI

- Cincinnati, OH

- Chicago, IL

Mid-priced properties outperform other quality classes

When by broken out by building quality, a large divide emerged between high-end apartments — known as four- and five-star apartments in the CoStar building rating system — and mid-priced properties, also known as three-star apartments. Annual asking rent growth has remained slightly negative in the luxury class, while mid-priced properties have outperformed the national average.

Positive absorption is positive for four- and five-star properties has not been strong enough to match the record levels of high-end units flooding the market. One- and two-star properties, on the other hand, have seen absorption remain negative for two and a half years. Renters in this price point have been hardest hit by inflation, which has discouraged household formation and forced some renters to seek alternative solutions, like moving in with roommates or family members.

Want more multifamily insights?

Watch the latest State of the Multifamily Market webinar, now available. In less than 10 minutes, CoStar’s Jay Lybik breaks down the latest rent growth, absorption, and construction data from the first quarter. You don’t want to miss this essential analysis. For closed captioning, click on the CC icon.

For additional insights, check out these articles and videos:

- Top 10 Multifamily Markets Facing Largest Rent Declines

- February Rent Growth Remains Sluggish

- Top 10 Multifamily Markets with the Highest Vacancy in Q1 2024

- 5 Predictions for the Multifamily Market in 2024

- Video: State of the U.S. Multifamily Market: 2023 Recap & 2024 Outlook

CoStar is the industry-leading source for information, analytics, and news about all areas of commercial real estate. Whether you’re an owner, investor, or apartment operator, you’ll find in-depth analysis from Jay Lybik and other experts to help you stay on top of the latest trends in the market. Learn more about CoStar.