Being a landlord can help you build wealth, but renting out your house for the first time will likely involve a learning curve. You'll have to navigate legal and financial obligations, as well as manage your rental property and tenants effectively. Before listing your house for rent, here's what you need to know.

In this article:

- Why Rent Out Your House?

- What You Need to Know as a First-Time Landlord

- Research Landlord and Tenant Laws

- Preparing Your House for Renters

- Advertise Your Property

- Create a Financial Plan

- Implement a Maintenance Tracking System

- Start Looking at Applications

- Create a Lease

- Collecting Security Deposits

- Collecting Rent

- Prepare for Move-In

- Stay Organized and Document Everything

- Retain Your Renters

Why Rent Your Home Out?

Renting a property out can be a profitable step towards financial independence, offering several benefits that contribute directly to your financial well-being. One of the primary advantages is the generation of passive income. This is income received regularly without having to put in a significant amount of active work. Essentially, your rental property works for you, contributing a steady stream of income that can cover your mortgage payments and potentially provide excess returns.

Beyond the appeal of passive income, becoming a landlord allows for the building of equity in your property. Over time, as you pay down the mortgage with the rent received, your equity — the portion of the property you truly "own" — increases. This is a dual-benefit situation where, aside from the rental income, you're also accumulating wealth as your property’s value appreciates over time.

Additionally, there are potential tax advantages to renting out your home. You might be able to deduct expenses related to the operation, maintenance, and improvement of your property, along with any interest paid on the mortgage. Be sure to consult with a tax professional to understand your specific tax situation and take advantage of any available deductions for your rental property.

What You Need to Know as a First-Time Landlord

First, start by determining if you want to manage the property yourself or hire a professional property manager. According to a recent survey, most landlords like to manage their property to save money. DIY management allows you to save money and control every aspect of the property, including collecting rent, handling maintenance, and screening applicants. However, if you live far away from the property, have a very busy schedule, or are just unfamiliar with managing a business, hiring a property manager is a good option. It’s common for property managers to charge up to 10 percent of the monthly rent along with other fees, such as 50 percent of the first month’s rent, when a new tenant moves in. Although hiring a property manager is another expense, they can help make your rental property profitable and ease your stress. Common duties for property managers include:

- Understand and navigate landlord-tenant laws appropriately

- Collect rent

- Advertise the property

- Screen and select tenants

- Sign leases

- Collect rent and other fees

- Keep track of finances

- Schedule maintenance repairs

- Issue legal notices

- Enforce rental policies, such as a pet policy

- File evictions

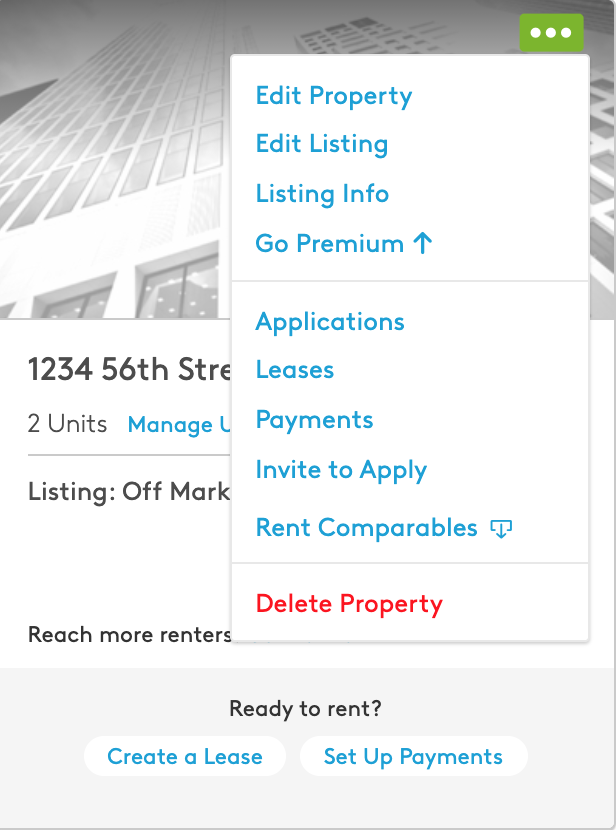

Similar to tenants, it’s important to find a property manager that will be the best fit. Do your research and ask the potential property manager plenty of questions to determine if you should hire them. If you decide to use a property manager, you can give them access to the property on Apartments.com Rental Tools, where they can manage rent and maintenance requests. To give your property manager access to your rental property on Apartments.com, please email support@apartments.com with the property address.

Research Landlord and Tenant Laws

Before you list your house for rent, start by researching local, federal, and state laws for both landlords and tenants.

State and local laws

Each state has varying laws for security deposits, notice letters, property access, and other issues, but there are some general rules to be aware of. For example, some states have rent control, which means there is a cap on how much rent you can charge. Similarly, many states have limits for security deposits and require landlords to keep deposits in a separate bank account since the money can only be used to complete repairs. Many states also recognize an implied covenant of quiet enjoyment, so landlords must provide a notice of entry 24 hours before entering a home for maintenance or renovations. Along with doing your own research online, you can contact your local housing authority or real estate attorney to help you learn about state and local laws.

Federal laws

You can view all landlord-tenant laws on the Department of Housing and Urban Development website. HUD also provides information about the Fair Housing Act, which prohibits housing discrimination due to a person’s race, color, national origin, religion, sex, familial status, and/or disability. When a landlord denies a rental application, they are required to provide the applicant with a letter detailing why. It’s vital that you understand fair housing laws before renting out your house. Similar to researching state laws, it’s recommended to consult with a real estate attorney.

Preparing Your House for Renters

Before you advertise your rental property, it's crucial to ensure your property is in top-notch condition. Starting with essential repairs, identify and address any issues that could pose a safety hazard or inconvenience to the occupants. This includes checking for leaks, ensuring all appliances are in working order, and making sure the heating, ventilation, and air conditioning (HVAC) systems are functioning efficiently.

Maintenance needs shouldn't be overlooked. Regular maintenance not only preserves the property's value but also enhances tenant satisfaction. Tasks such as servicing the HVAC system, cleaning gutters, and ensuring the plumbing system works properly are vital.

To further attract potential tenants, assess your property’s curb appeal. Simple cosmetic improvements like a fresh coat of paint, updated fixtures, and a well-maintained landscape can make a world of difference. These enhancements not only make the property more appealing but also can allow for a higher rental price.

Lastly, make sure your property complies with all safety regulations and codes for residential rentals. This includes installing smoke detectors and carbon monoxide detectors and ensuring all exits are accessible and properly marked in case of an emergency. Compliance with these regulations not only protects your tenants but also helps you avoid potential legal issues.

Taking the time to thoroughly prepare your property for renters can lead to a more profitable and stress-free rental experience for both you and your potential tenants.

Where to Advertise A Home for Rent

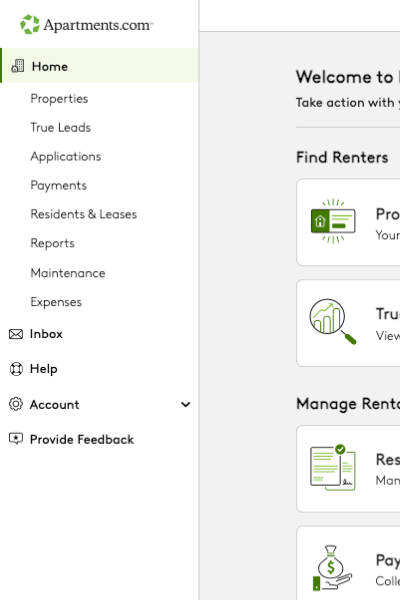

There are several ways to advertise your home, but your best option is to start with Apartments.com Rental Tools. On Apartments.com, you can advertise one house or multiple all under the same account, making it easy to find the perfect renter.

To get started, go to the Apartments.com homepage, click on “Add a Property,” and then select “Single Family Home,” “Condo,” “Townhouse,” or “Apartment.” Select “Single Family Home” and enter the address of your rental home. After you have put in the address and all the rest of the information about your home, hit continue. Now, you are one step closer to advertising your house for rent. Once you have set everything up and your property is posted on Apartments.com, you can manage your applications, leases, payments and even maintenance requests all from the same account.

Create a Financial Plan

A solid financial plan for your rental home is one of the most important parts of any rental home, but especially if it’s your first.

Application Fee

An application fee is a fee that many potential renters are familiar with. Usually, renters must pay an application fee for each house they apply to. But with Apartments.com renters only pay $29.99 + tax for 10 applications. This money is used to make sure all information the renter provides is secure, and it covers the tenant screening performed by TransUnion. As a landlord this benefits you because you won’t have to worry about collecting an application fee or running your own kind of screening since TransUnion provides you information such as a credit report, an eviction report, annual income, and income to rent.

Deposit

A security deposit is an important fee that landlords collect before a tenant moves in. It protects you in case the tenant breaks the lease. It also helps cover damages if the tenant moves out. Remember to keep the security deposit because it must be returned to the tenant at the end of the lease.

A standard amount for a security deposit is one to two months’ rent. But of course, always check your local and state laws to make sure you are charging the right amount.

Set Rent

The most essential part of placing your house for rent for the first time is setting the rent. When setting your price, you want to strike a balance between a rate that is higher than your expenses, but low enough to attract tenants. Several factors such as the value of your house, location, and size will impact your final rate, but rent price is generally determined by the market. Your house will most likely have the same rent price as other houses in your area that are of similar size and condition. Conduct thorough research by examining nearby properties and reaching out to local landlords and property management firms. This valuable information is readily available in a rent comps report. If you use Apartments.com Rental Tools, you’ll have access to rent comparable report which informs you of the rent prices in your zip codes that have similar bedroom and bathroom counts to your house.

Additional Expenses

Finally, it’s important to consider additional expenses you’ll encounter as a landlord.

A few common expenses for renting out a house include:

- Landlord insurance

- Mortgage payments

- Routine maintenance

- Repairs and/or renovations

- Inspections

- Pest control

- Insurance

- Attorney fees

- Accountant fees

- Property management fees

Contact local property management companies to get a good estimate for expenses. Communicate with local landlords for advice about expense planning. It’s also a good idea to contact local utility companies. Knowing the average cost for monthly utilities could help you determine if you want to include utilities in the rent, charge your tenant a monthly fee, or require your renter to be completely responsible for utilities. Being familiar with utility costs can also help you identify issues with your HVAC since you’ll be able to notice any unusual spikes in the bill.

Reaching out to a real estate lawyer and an accountant is highly recommended since they can ensure you follow local property laws, tax laws, zoning ordinances, and more. A real estate accountant will help you craft a realistic budget and understand which tax deductions you might qualify for. Although you might qualify for several deductions, there are limits on how much you can deduct each year. Along with ensuring you’re following federal and state landlord-tenant laws, a lawyer can help draft a lease and include important house rules such as a cleaning clause. When you use Apartments.com Rental Tools, you can create a lease customized to your local laws and add different addendums specific to your house.

Implement a Maintenance Tracking System

Maintenance issues are common for any kind of rental house. To keep track of maintenance issues, implement a maintenance tracking system.

Apartments.com Rental Tools allows your tenants to make requests through their account and you will receive them via email. Both you and your renters can send messages on open maintenance requests, allowing both of you to ask and answer questions, as well as send pictures and videos. Once the request is closed, one final email will be sent to let the tenant know the repair was completed.

With Apartments.com, you can create private issues through the maintenance requests feature in Rental Tools that no tenant can see so you can keep track of maintenance issues. You’ll be able to select which property you would like to create an issue for and enter a description of the issue in the textbox.

Start Looking at Applications

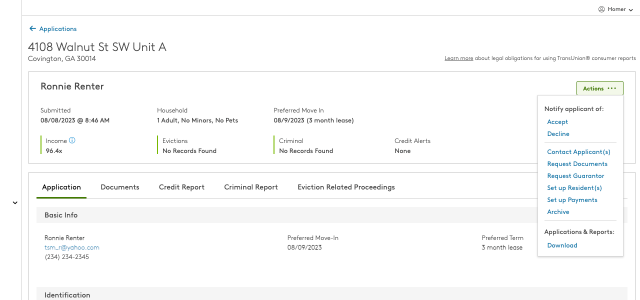

If you’re using Apartments.com Rental Tools, you can collect applications and screening reports entirely online.

Your listing will feature an “Apply Now” button, where renters can click and directly apply on their computer or mobile device.

Apartments.com Online Applications Include:

- Your renter's name and contact info

- Preferred move in date

- Any co-applicants, minors, guarantors, or pets who will be living with the main applicant

- Residence history, employment & income details, and references.

- Government Issued Identification

- Vehicle information

You can also invite renters to apply on Apartments.com. To invite them, all you will need is their full name and email address.

Once an applicant has applied, you will receive an email. You can view the applications directly from your dashboard and contact them if you need more info.

After you receive an application, you’ll have a few options:

-

View Application: This will show your applicant's contact info, which is useful if you need to schedule a showing or ask them a question.

-

Accept: This sends your renters a notification that their application was selected, and they got the home.

-

Request Guarantor: This lets applicants know they’ll need to add a guarantor to undersign the application and any lease agreements.

-

Decline: Choosing this option will send a notification and let the applicant know they were declined. At that point, you’ll no longer have access to the application and screening reports.

-

Set Up Residents: This will take you to Apartments.com's lease builder so you can create a lease agreement with the applicant.

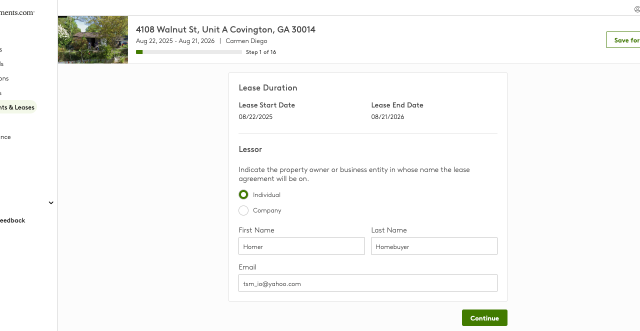

Create a Lease

By using Apartments.com Rental Tools you can create a lease from your account and have your renters sign the lease from their account. Apartments.com's house lease templates are fully customizable, so you can add specific clauses and house rules.

To create a lease, go to Rental Tools and select Residents. Here you can manage your house rental details all in one place.

Once you set up a resident, scroll down to Lease Document and select Create a New Lease. Make sure you put in your information as the owner.

In the Residents/Guarantors section, you can add anyone who should be on the lease.

Before you can create a lease, you will answer a few questions about your rental property and lease preferences such as:

- What type of property you're renting: Single Family Home or Multi Family Home (such as an apartment or condo)

- Property Contacts

- Rent amount, when it’s due, any late or insufficient funds fees, and the security deposit amount

- Pets and any restrictions around breeds, weight, or number of pets. You can also add a monthly pet fee and any violation fees

- Details about your property’s parking situation and utilities

- Additional fees or other move-in costs that aren’t part of your monthly rent payments

- The payment methods you’ll accept (check, EFT, or online payments through Apartments.com)

- Utilities included in the rent

- Special stipulations and property disclosures

Once you have answered these questions you can review the lease by clicking on Download Lease. If you want to change the wording of the lease you can add different stipulations. You may also upload your own lease to Apartments.com Rental Tools by going under “Residents” and selecting “Set up new Resident.” After the resident has been set up, the next screen is the resident recording where you can upload the lease under “Shared Documents.”

To send your lease to your potential tenants, select Confirm and send the lease.

Once your potential tenant signs the lease, they are all set. If they lose the email or forget about it, you can send them a reminder to complete the lease.

If you or the potential tenant request a change to the lease, you may edit it by adding an addendum or creating a new lease. If you or the resident has signed the lease, then both parties must sign the updated lease. If both parties have already signed the lease, then a new lease must be created with the edits and both parties must sign the new lease.

Collecting Security Deposit

After you have set up your Payments and you have added your tenant, you can add a bill before the first rent payment. To be able to do this you will just have to make sure you select the correct bill.

Collecting Rent

Once your tenant has signed the lease, there are just a few more steps until you have officially rented out your house.

Before you let your tenant move in, collect the rent and the security deposit. According to the Apartments.com survey, 31% of landlords say their biggest pain point is collecting rent. Luckily, Apartments.com Rental Tools allows you to collect rental payments with no additional fees.

Before you get started, you will need your tenant’s email address and the details of the checking account where you would like to accept payments.

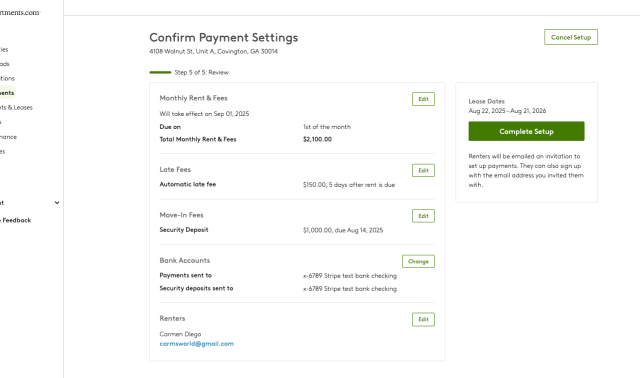

From your Rental Tools Dashboard, visit the Payments section and choose “Set Up Payments.” Select the property you would like to collect rent on and finally, click “Confirm and Invite.” Your tenants will receive an email that will guide them through the payments process.

If you need to check the status of a payment, visit Payments under Rental Tools, and then click “All Transactions” on the unit you would like to check on.

Sometimes tenants can be late on rent, therefore it is essential to send a due date for rent. Often landlords will give tenants a three-day grace period for rent. For example, Rent is due 7/1 but tenants have until 7/4 to pay rent to avoid a late fee.

Late Fee

Sometimes, tenants will be late paying rent. When this happens, Rental Tools allows you to add an automatic late fee. You can add the automatic late fee when you set up payments for your tenants.

The most common late fee is 5% of the rent, but always check your local and state laws before adding any fees.

Prepare for Move-In

After your tenant has signed the lease and has paid their security deposit and first month’s rent, congrats! Now it’s time to prepare for move-in. Here are some things you may want to consider doing before your tenant moves in:

- Create keys: if you’re renting a house for the first time it’s essential to create keys for each of your tenants.

- Maintain yard: make sure you cut the grass before move-in day and either hire a regular landscaper, cut the grass yourself, or ask your tenant if they can cut the grass

- Deep clean: It is essential you deep clean the house before anyone moves in. You can do this yourself or hire a cleaning company.

After you have completed everything on your to-do list, make sure you schedule a move-in date with your tenant and you’re ready for your new role as a landlord.

Stay Organized and Document Everything

Being unorganized will not only cause a headache, but it could also lead to several consequences including loss of income and litigation. If you’re managing the property yourself, remember these three words: document, document, and document! Every task you complete should be documented in a physical file and/or digitally. Apartments.com Rental Tools gives you the perfect digital space to document everything. Here are some examples of items you can properly document and store with your Apartments.com account:

- Any communication between tenants, maintenance, etc.

- All receipts and invoices for repairs and renovations

- Copies of current and former leases

You should keep photos and videos showing the state of the property before and after tenants move in and out. Also be sure to keep track of any taxes as well as any copies of additional legal notices.

These examples are just the tip of the iceberg when it comes to expense tracking for landlords. Although DIY management is cost effective, don’t be afraid to reach out to professionals for tips and help.

Retain Your Renters

Retaining renters is the easiest way to ensure your rental property remains profitable. If your current tenants renew their lease, you won’t have to worry about finding new tenants to fill the vacancy. The longer your house sits vacant, the more money you will lose. Providing a welcome basket, handling maintenance issues quickly, and allowing pets are several methods for resident retention.

Renting out your house is an excellent way to set yourself up for financial success. Whether you hire a property manager or go DIY, remember to stay organized and keep local and federal laws in mind. Although it might seem overwhelming at first, becoming a landlord is doable with extensive research and Apartments.com Rental Tools!