Easily Track Rental Property Income and Expenses

Track expenses for your rental property with Apartments.com. Effortlessly manage your income and rental property expenses anytime, anywhere with our easy-to-use property expense tracking platform.

Simple, Accurate Property Management Expense Tracking

Whether you’re working via computer or managing rentals on your phone, Apartments.com helps you tackle your your rental property income and expenses by allowing you to:

- Track your rental expenses by property

- Assign each expense to a tax category

- Quickly and easily attach images or receipts

Simplify Tax Season

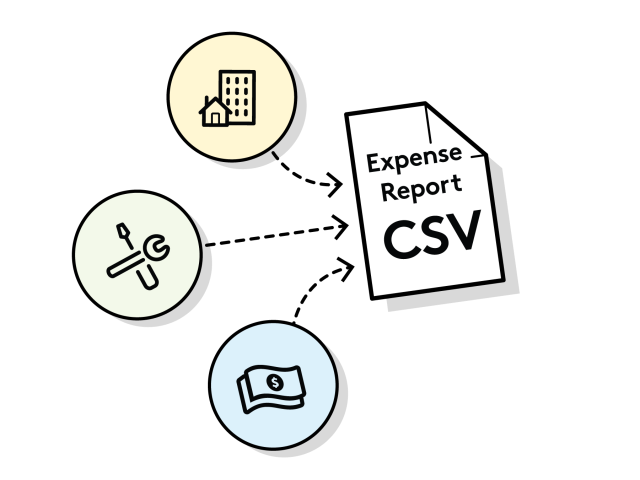

Easily track your rental property finances and be prepared for tax season! Our rental property expense tracking platform helps you summarize all your rental expenses by property and tax category and then easily export them to CSV or PDF formats. Whether you hire an accountant or file your own taxes, tax season is a cinch when you use Apartments.com to track your rental property income and expenses.

Start Tracking Rental Income and Expenses

Frequently Asked Questions

-

How do I track my rental expenses on Apartments.com?

Apartments.com makes it easy for you to track all of the expenses related to your rental properties.

You can track and categorize expenses based on the IRS' Schedule E (Form 1040).

-

What type of rental expenses can I claim?

Property Managers can claim a variety of rental expenses. Rental expenses include fixed operating or absorptions costs and are considered landlord tax deductions. They are expenses associated with managing and running the rental property, making them tax deductions. Expenses like office space, storage space, salaries, and retail space are considered rental expenses.