Tax season can be a stressful time for landlords. From filling out forms to tracking down expense receipts and meeting deadlines, there's a lot to manage. But what if we told you there's a solution that can simplify the process? Enter Apartments.com - more than just a platform for listing properties, it's a tool designed to streamline your financial management and make tax filing a breeze. This article will show you how to leverage Apartments.com to ease your tax season woes and make filing your taxes easier.

Understanding 1099-K Forms

There are specific guidelines to follow before filing taxes and reporting rental income. If you own a rental property and rent it out, it is crucial to report all rental income when filing your tax return. Rental income can be received through various methods, such as online payment apps.

Starting in 2022, it became mandatory to report rental income received through payment apps if the total gross payment exceeded $20,000 and 200 transactions in a year. However, for the 2023 tax year, the IRS delayed the implementation of the reduced threshold of $600. Instead, the previous threshold of $20,000 with 200 transactions remained applicable.

Over the next two years, the IRS plans to lower the reporting threshold to $600. The proposed threshold for reporting Form 1099-K is set to decrease to $5,000 for the 2024 tax year, and $600 for the 2025 tax year. Consequently, landlords and property managers can expect to receive Form 1099-K from online payment entities if their rental income from online transactions exceeds $20,000 during the year. Given recent rent trends in the United States, more landlords are likely to qualify for a 1099-K form.

What Is a 1099-K Form?

The 1099-K form, or Payment Card and Third-Party Network Transactions, is a document that the IRS requires payment settlement entities to use. Basically, if you're a landlord who receives rent payments through online platforms like Apartments.com, you'll likely receive a 1099-K form.

This form reports the gross amount of all reportable payment transactions. In simpler terms, it shows how much money you've received from your rental properties in a year. It's crucial to keep track of this information, as it'll play a big part in your tax filings.

Tips for Staying Organized and Ensuring Accurate Record-Keeping

For landlords, maintaining meticulous records throughout the year is paramount to a smooth tax filing process. Incorporating some simple strategies can save you a significant amount of time and stress during tax season. Here are a few tips to help keep you organized:

-

Use digital tools for record-keeping: Leverage technology by using digital platforms like Apartments.com for managing rental transactions. Our expense tracking platform helps you summarize rental expenses by property and tax category. From there, you can easily export them to CSV or PDF formats to make doing your taxes a breeze. Unlike our competitors, there’s no need to go off-site to a third party for required forms. With Apartments.com, you can download the required tax filing forms directly from your account, and they are backed up for seven years.

-

Create a filing system: Whether you choose to use a digital system, a physical file cabinet, or both, having a dedicated filing system is crucial. Organize your documents by year and category (e.g., income, repairs, utilities). Clearly label each file for easy retrieval.

-

Document every transaction: Keep detailed records of every rental transaction, including rent payments, security deposits, and maintenance expenses. This will help you accurately report your income and deductions when filing taxes.

-

Stay up-to-date on tax laws: Tax laws and regulations are constantly evolving, so it's important to stay informed. Consider consulting with a real estate accountant to ensure you're aware of any changes that may impact your tax filing as a landlord.

How to Track Rental Expenses on Apartments.com

Tracking rental expenses is crucial for landlords to maintain accurate financial records and ensure a smooth tax filing process. As mentioned earlier, Apartments.com makes it easy for you to track all of the expenses related to your rental properties.

You can track and categorize expenses based on the IRS' Schedule E (Form 1040).

To add a new expense:

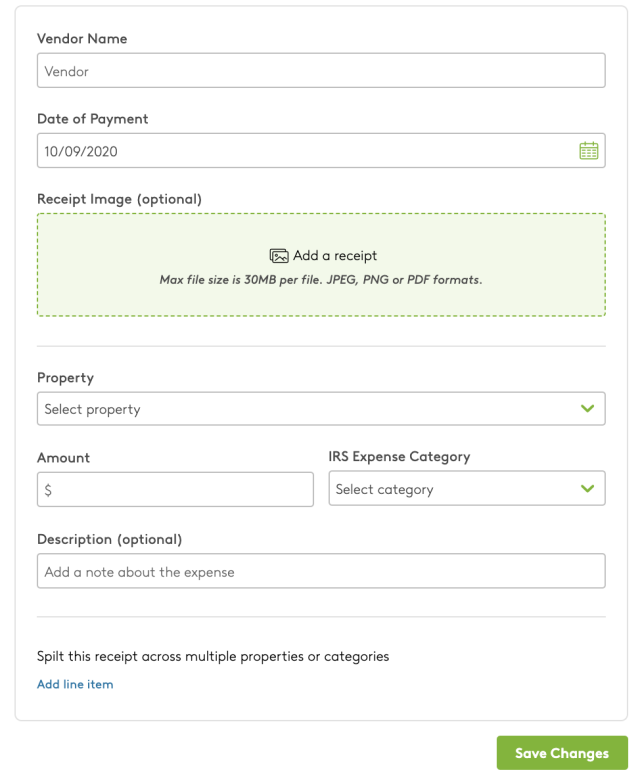

1. Click on Expenses, which you can find under Rental Tools 2. Select "Add Expense" 3. Enter in the details of the expense:

4. If a single receipt contains many expenses, select "Add line item" which will allow you to split that receipt across multiple properties or categories.

To see which receipts have been split, look for the fork icon on your Expenses page:

Once you have added your expenses to the expense tracker, you will be able to download your expense report from a custom date range or a certain calendar year. Then, this expense report can be used to help you file your taxes.

How to Use Apartments.com to File Your Taxes

Luckily, if you collect rent payments through Apartments.com, we will electronically send you a 1099-K form for your filing purposes. When collecting rent on Apartments.com, we’ll ask for your bank account ownership details upfront to minimize interruption during the lease. But be sure to refer to your state laws because some states have reporting thresholds different from those of the federal government. If your property income is over the listed reporting threshold, Apartments.com is required to file a Form 1099-K with the IRS. For more information on these different thresholds, refer to the table below:

|

State |

Reporting Threshold |

|

Arkansas |

$2,500 |

|

District of Columbia |

$600 |

|

Illinois |

$1,000 and 4 transactions |

|

Maryland |

$600 |

|

Massachusetts |

$600 |

|

Montana |

$600 |

|

New Jersey |

$1,000 |

|

North Carolina |

$600 |

|

Rhode Island |

$100 |

|

Vermont |

$600 |

|

Virginia |

$600 |

What Do I Do After I Receive a 1099-K Form?

Once you receive a 1099-K form, it's important to understand what it means and how to handle it. This form indicates the gross amount of all reportable payment transactions you received in the past year. Essentially, it's a record of your income from certain sources, particularly online platforms or payment apps.

Here are some steps to follow after receiving a 1099-K form:

1. Review your form: The first thing you should do is review your 1099-K form. Ensure all the information on the form is accurate, including your taxpayer identification number. If there is an issue with your 1099-K form, you will need to make a correction. To minimize the need for requesting a correction, Apartments.com will notify you at the start of the following tax year of a two-week time frame to update your bank account ownership information before it’s reported to the IRS.

2. Calculate your income: Use the reported amount of income on your 1099-K form, along with other amounts received in the form of cash, checks, and debit or credit payments, to calculate your total income.

3. Report your income: Depending on why you received the 1099-K income, you may have to report it differently on your tax return. It's crucial to report this income when preparing your taxes accurately.

4. Pay any owed taxes: If you've made a profit, it's possible you'll owe taxes. Ensure to settle any owed taxes to avoid penalties.

Remember, while Apartments.com's tool can assist with general tax information, it may not cover all scenarios. It's crucial to consult a tax professional for personalized advice to ensure accurate reporting and compliance with tax regulations.

How Do I Report Rental Income?

After you receive your 1099-K, you need to file your taxes and report any rental income. As a landlord or property owner, you report your rental income and any additional expenses using a Schedule E (1040 Tax Form). This form requires you to provide information about your property, such as all of your rental income.

Being a property owner goes beyond finding the right property and tenants. It also involves understanding and navigating the financial aspects. Remember, forms like 1099-K are tools that help you accurately report income and comply with tax laws. Don't let tax season catch you off guard. Take the time to review your 1099-K form, calculate your total income, report it accurately, and settle any owed taxes. If you're ever in doubt, don't hesitate to seek assistance from a tax professional. Ultimately, it's better to be safe than sorry.

The above information is in no way intended to be a substitute for qualified legal advice. Please conduct your own research and comply with all your state and local laws. If you need tax advice, please contact a tax professional or real estate lawyer in your area.