2023 was marked by record-high supply and declining rent growth. Looking ahead to this year, what can the industry expect? Here are the top predictions from CoStar for the multifamily sector in 2024.

1. Rent growth will increase

2023 was a difficult year for rent growth. Nationwide, year-over-year rent growth was far outpaced by inflation, falling to a mere 0.9 percent by December. In fact, 20 of the major markets ended the year with zero or negative rent growth, said Jay Lybik, CoStar’s national director of multifamily analytics in a recent webinar for Apartments.com.

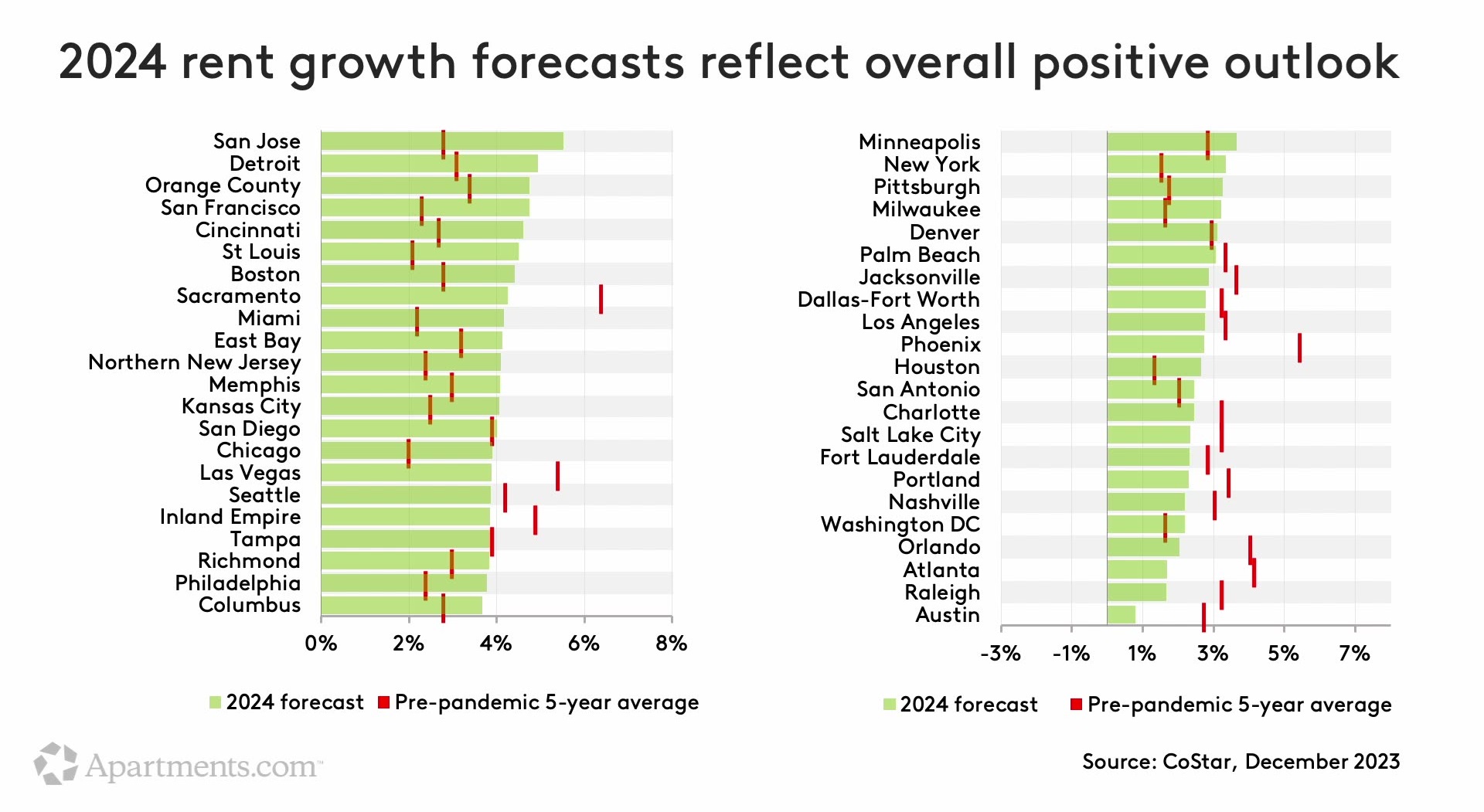

But 2024 offers a brighter picture. With supply–demand pressures expected to ease in the months ahead, rent growth is projected to increase, and all major markets are expected to end the year in positive territory, though 40 percent won’t regain their five-year pre-pandemic average.

2. Completions of new construction will slow

After 2023 saw a 40-year high for completed units, delivery of new units is expected to slow down this year. Although still high at 450,000, the number of units projected to come online this year is a 25-percent drop from the nearly 600,000 delivered last year.

This slowdown in the pipeline will offer some relief to markets hit hard by oversupply.

Like in 2023, the Sun Belt is expected to see the highest numbers of units completed. Atlanta, Austin, Charlotte, and Phoenix are each expected to gain an additional 14,000 to 16,000 units this year, while the Dallas–Fort Worth market in Texas will gain the highest number of units: 27,000 total.

Coming in second for absolute numbers, New York City will gain 21,700 new units, but relative to the metro’s size and high demand, this addition is unlikely to have the impact of deliveries in the oversupplied Sun Belt. Charlotte, for example, is projected to expand its inventory this year by 7 percent.

3. Demand will creep upwards

Absorption in 2023 rose by 124 percent, indicating an “impressive” rebound in demand, Lybik said. However, the impact of this rise has been overshadowed by excess supply.

Even so, this trendline will likely continue throughout 2024. Demand is expected to continue its incremental climb upwards. The supply–demand imbalance that drove nearly two dozen major markets into negative territory last year is projected to start edging towards equilibrium.

4. Mid-priced properties will see rents grow further

The pressures of high supply and weak demand have varied drastically by quality class. Luxury apartments, also known as four- and five-star apartments in the CoStar rating system, have borne the brunt of the oversupply and struggled with the greatest declines in asking rent. The middle of the market, on the other hand, saw early signs of stabilization in 2023.

Looking ahead to the rest of the year, this mid-priced category — also known as three-star properties — is expected to continue to thrive. This class saw 1.5 percent rent growth in 2023, notably higher than the national average of 0.9 percent. Lybik predicts that three-star apartments in 2024 will “lead the rent growth expansion,” further buoyed by the expected slowdown in new deliveries.

5. Formerly hot Sun Belt markets will continue to struggle

During the pandemic, increased migration to the Sun Belt fueled the multifamily building boom behind today’s oversupply. Even as rent growth begins to recover this year, performance in these Sun Belt markets will remain weak.

Atlanta, Charlotte, Jacksonville, Orlando, and Austin ended 2023 with the steepest rent declines in the nation. In 2024, Austin won’t return to positive territory until the last quarter of the year.

The markets most at risk of oversupply in 2024 are all in the Sun Belt and Southeast: Miami, Charlotte, Austin, Nashville, and Raleigh.

While these regions struggle, the Midwest and Northeast are expected to continue to surge ahead. These rent growth leaders have seen limited new supply, keeping their markets in a healthier balance, and allowing for the highest rent growth in the country.

Looking for more multifamily insights? CoStar is the industry-leading source for information, analytics, and news about all areas of commercial real estate. Whether you’re an owner, investor, or apartment operator, you’ll find in-depth analysis from Jay Lybik and other experts to help you stay on top of the latest trends in the market. Learn more about CoStar.