The multifamily sector closed the year with a few positive signs amid tough market conditions. Despite the flood of excess supply, absorption ticked upwards in late 2023, rising by 122 percent to 332,000 units year over year.

While still eclipsed by record-high supply, this increase in demand could lay the foundation for a healthier supply–demand dynamic in 2024, as new deliveries are expected to slow in the months ahead.

“The U.S. multifamily market staged a strong rebound in 2023,” said Jay Lybik, CoStar’s national director of multifamily analytics, in a recent press release. “With fewer unit completions slated for this year, 2024 may offer some reprieve for the multifamily market.”

Though insufficient to reverse the headwinds facing the multifamily industry, these positive trends offer glimpses of hope for a market that has been hit hard by new deliveries, insufficient demand, and declining rent growth.

2023’s high supply drives down rent growth

A record high not seen since the mid-1980s, 2023 marked a total delivery of 565,000 new units. This glut of supply pushed the national vacancy rate to 7.5 percent in December, over 100 basis points higher than December of the previous year. This marked a nine-quarter trend of supply outstripping demand. For four and five-star properties, the vacancy rate soared even higher, ending the year at over 10 percent.

At the same time, year-over-year rent growth continued to decelerate from a national average of 3.9 percent at the beginning of 2023 to 0.9 percent by the end of the year.

Midwest and Northeast lead the nation in rent growth

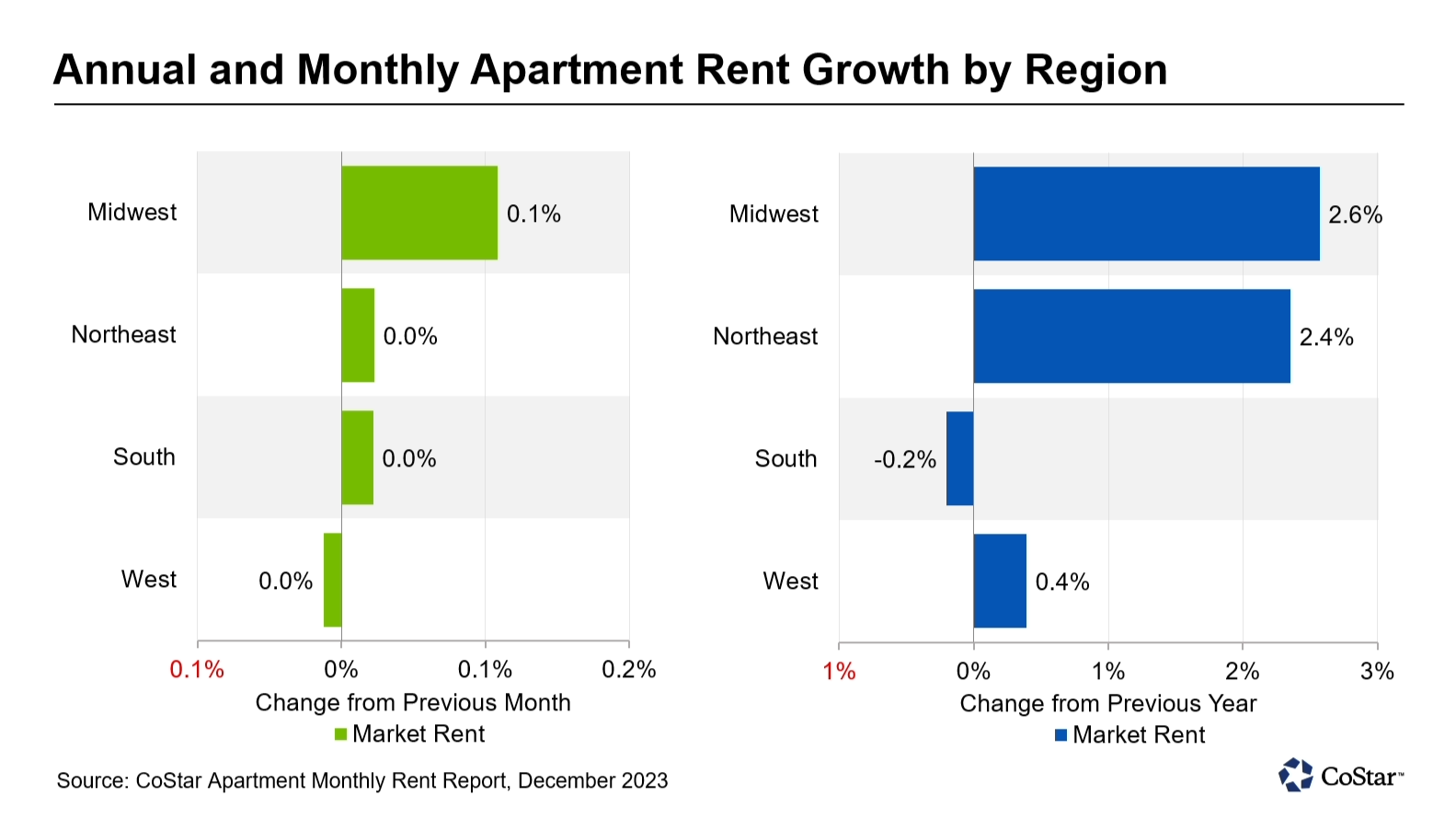

Regional markets facing fewer deliveries maintained a relatively healthy balance between supply and demand throughout 2023. The Midwest and Northeast markets, where new construction was limited, maintained the highest rent growth in the country.

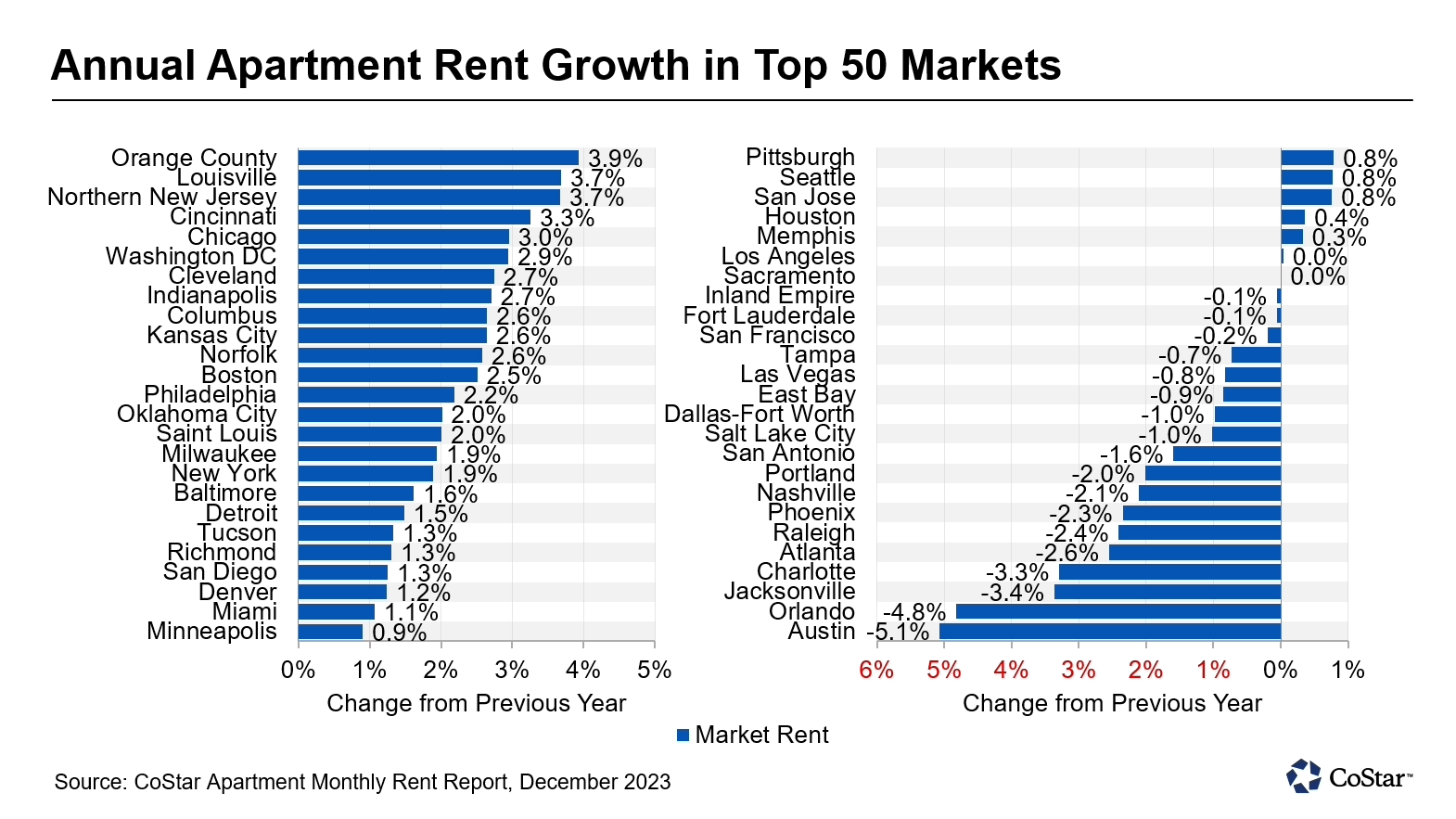

Markets in the West saw a moderation of rent growth, as both demand and deliveries slowed. The Sun Belt suffered the greatest declines in rent growth. This trend was most pronounced in the South, which has faced the largest influx of excess supply in recent quarters. Austin, Orlando, Jacksonville, Charlotte, and Atlanta posted the greatest drops in year-over-year asking rent of all major markets.

Orange County rises to the top

Bucking the regional trend, California’s Orange County took the top spot for year-over-year rent growth, posting 3.9 percent growth in December, while simultaneously emerging among the top 10 markets for highest rent per square foot.

Otherwise, rent growth leaders generally followed the regional trends, with the Midwestern and Northeastern markets of Louisville, Northern New Jersey, Cincinnati, and Chicago close behind Orange County within the top five.

Mid-priced properties see the greatest demand

2023’s new deliveries saw a concentration of high-end properties, which pushed rent growth for the four- and five-star segment to negative 0.4 percent by the end of the year.

Mid-priced properties, also known as three-star apartments, gained the most from recent boosts in consumer confidence. Rent growth for this segment rose 1.4 percent year over year, as the twin factors of weakening inflation and the absence of recession helped boost renter demand.

The low end of the market, however, saw continued weak demand, as economic challenges took a greater toll on low-income renters. One- and two-star properties posted their second consecutive year of negative absorption.

2024 offers signs of improvement

The record-high deliveries of 2023 are expected to level off this year, with 440,000 units projected to deliver between January and December. This slowdown should help lessen the supply–demand imbalance that characterized the last 12 months.

However, Sun Belt markets and the luxury price point will continue to bear the brunt of oversupply. Markets in the Midwest and Northeast, along with mid-priced properties, are expected to continue to shine as rent growth leaders throughout 2024.

Check out the webinar for more analysis

In just seven minutes, CoStar’s Jay Lybik breaks down the latest multifamily market data and offers his predictions for 2024. Watch now: