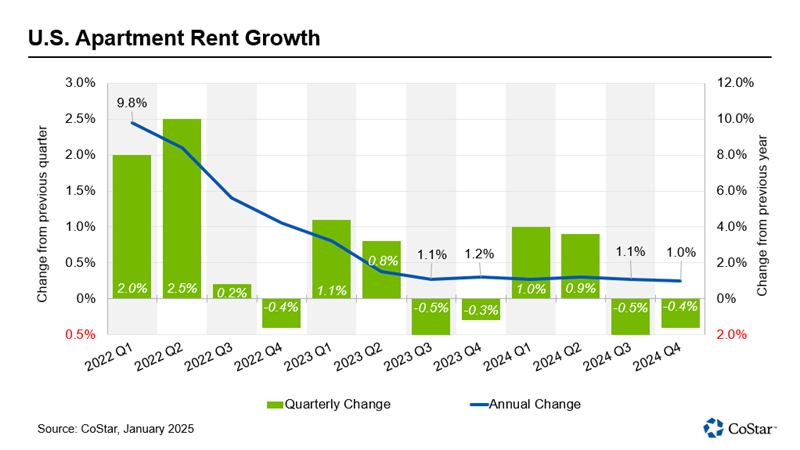

2024 ended with rent growth continuing to hover around 1 percent, according to the latest rent growth report from Apartments.com. The year marked a 40-year record in new supply and saw a plateauing of the national vacancy rate.

Rent growth remains minimal

The national average for year-over-year asking rent has stayed at or near 1 percent since the middle of 2023. This small year-over-year increase brought the average rent per unit up to $1,729, compared to $1,712 in 2023, according to CoStar data.

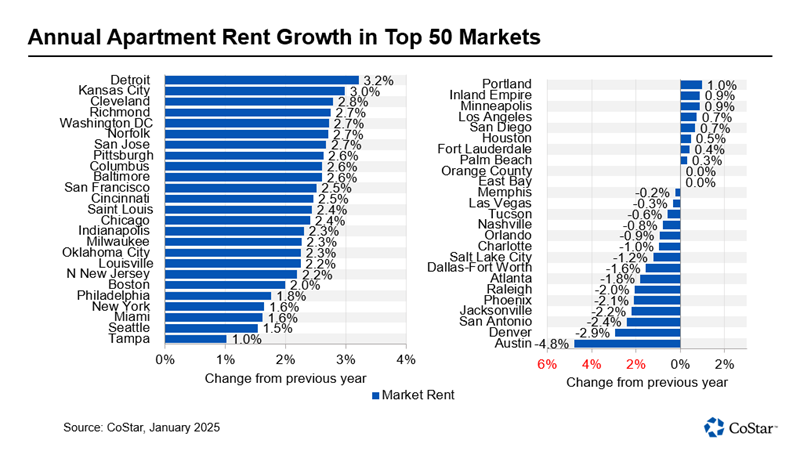

Local rent growth averages ranged across major markets from a high of 3.2 percent in Detroit, Michigan, to a low of negative 4.8 percent in Austin, Texas.

Rent growth wasn’t the only key indicator that saw little change throughout the year. Vacancy stayed relatively stable throughout 2024, closing the year at 8 percent. This was a slight increase from 7.8 percent in the first quarter of 2024.

The vacancy rate for luxury apartments stayed in double digits, ending 2024 at 11.4 percent. These properties, known as four- and five-star properties in the CoStar building rating system, have seen the brunt of the new multifamily supply delivered in 2024.

Despite the stability of rent growth and vacancy, 2024 saw a dramatic shift in absorption. A total of 556,800 units were absorbed during the year, peaking at 165,400 in the third quarter and slowing to 113,200 in the fourth quarter. This was nearly a 70 percent increase in absorption compared to 2023.

Masking this increase was the record-high supply that flooded the market. With 675,000 delivered in 2024, new supply hit a high not witnessed since the mid-1980s.

Even the rise in demand wasn’t enough to outpace the torrent of new supply, it still helped shrink the supply–demand gap shrunk to the smallest it’s been in the last three years.

Midwest and Northeast continue to dominate rent growth charts

The top multifamily markets for rent growth remain in the Midwest and Northeast. Detroit took the top spot with 3.2 percent rent growth, followed by Kansas City at 3% and Cleveland at 2.8 percent.

The region hardest hit by new supply, the Sun Belt remains a bottom performer. Rent growth was negative for 12 Sun Belt markets, with Austin trailing behind the most dramatically. Asking rents in the Texas capital fell year over year by 4.8 percent.

Rent growth in San Antonio, Jacksonville, Phoenix, Raleigh, and Atlanta came in around negative 2 percent, ranging from negative 2.4 percent in San Antonio to negative 1.8 percent in Atlanta.

The West shows scattered performance

Two markets from the West — Denver and Salt Lake City — joined the major markets at the bottom of the rent growth charts. The Colorado capital posted rent growth of negative 2.9 percent, while the Utah metro saw rent growth of negative 1.2 percent.

Markets in the West showed a mixed performance, ranging from bottom performers like Denver and Salt Lake City to a few surprise winners. Northern California’s San Jose market took the #7 spot with rent growth of 2.7 percent, and the San Francisco market crept up to the 11th spot with 2.5 percent. At the same time, the nearby East Bay market broke even with no rent growth.

The Sunshine State outshines the Sun Belt

Even as the Sun Belt region ended the year with negative growth overall, one state stood out. Florida, home to several major multifamily markets, saw a stronger performance than its fellow markets in the Sun Belt.

Four of the six major multifamily markets in Florida closed the year with positive rent growth. Miami led the way with 1.6 percent rent growth, followed by Tampa at 1 percent. While they underperformed the national average, Fort Lauderdale and Palm Beach stayed in the black with 0.4 percent and 0.3 percent, respectively. Only Orlando and Jacksonville, which posted rent growth of negative 0.9 and negative 2.2 percent, saw their asking rents decline year over year.