The multifamily market kicked off the new year with a slight upward tick in asking rent. This positive but weak trend reflects the gradual pace of recovery within a market struggling with inflation, excess supply, and insufficient demand.

Rent growth remains slow but positive

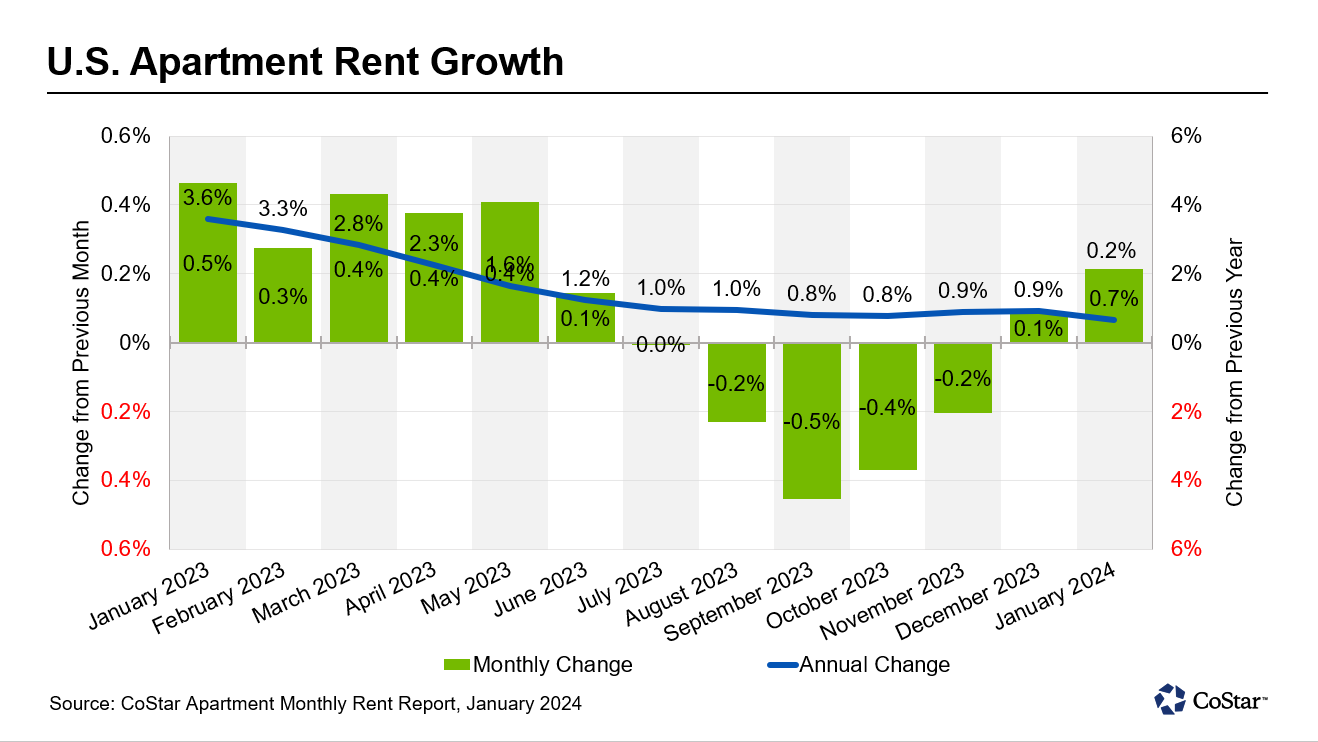

After four straight months of monthly rent declines in 2023, December was the first month to see rents increase over the previous month, when they trended upwards by 0.1 percent. This trend has continued in January, with asking rents increasing by 0.2 percent. Although this rise is minimal, it represents a positive trendline.

Zooming out to the annual perspective, rent growth averaged 0.7 percent nationwide, compared to January 2023. This continues a trend of decelerating rent growth. Year-over-year rent growth has dropped nearly 3 percentage points from 3.6 percent a year ago. Despite this slowdown in gains, growth has remained positive at the national level, while some regional and local markets have seen gains reverse into losses.

The South struggles in face of high supply

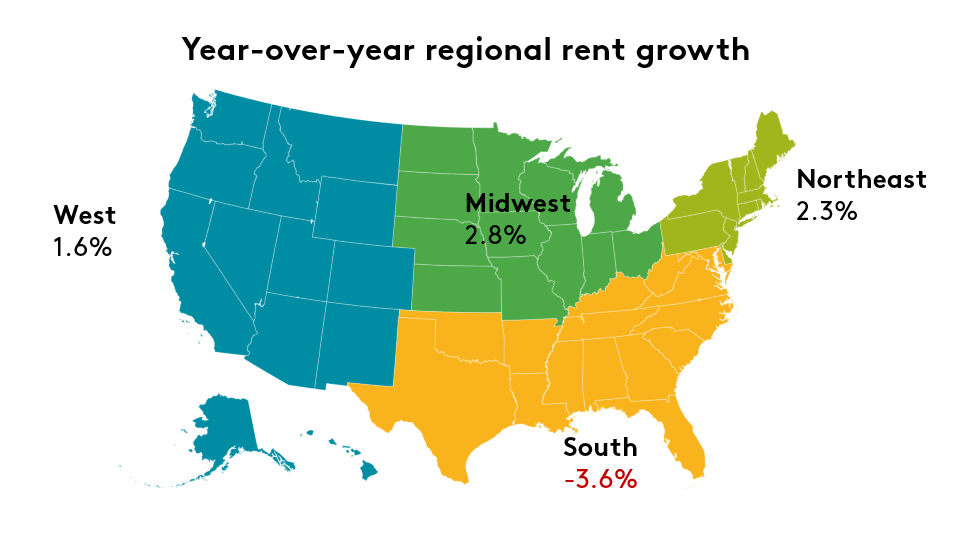

At the regional level, the South has seen the greatest drops in asking rent. January’s numbers showed a decline of 3.6 percent compared to the same period in 2023. The three other regions all stayed in positive territory, with 2.8 percent growth in the Midwest, 2.3 percent growth in the Northeast, and 1.6 percent growth in the West.

Which Southern markets were hit the hardest? Overwhelmed by high supply, Austin, Atlanta, Orlando, and Raleigh saw the greatest declines.

Markets with greatest rent declines

| Local market | Year-over-year change in asking rent |

1 | Austin, TX | -5.4% |

2 | Atlanta, GA | -3.1% |

3 | Orlando, FL | -3.1% |

4 | Raleigh, NC | -2.6% |

5 | Jacksonville, FL | -2.5% |

6 | Nashville, TN | -2.5% |

Midwest and Northeast drive growth, while West sees mixed performance

Continuing their lead in 2023, the Midwest and Northeast saw the greatest increases in asking rent. The picture for the West was more varied, with some markets in this region rising to the top 10, while others fell into negative territory.

Although its month-over-month growth in January saw the greatest drop nationwide, Orange County was a top performer in annual growth and took the #10 slot for rent growth.

Portland, on the other hand, fell between San Antonio and Nashville among bottom performers, with year-over-year growth of negative 2.1 percent. Other Western markets that struggled included Salt Lake City, California’s East Bay, and Las Vegas.

Falling somewhere in the middle were markets such as Tucson (1.3 percent), San Jose (1 percent), and Seattle (0.9 percent), and San Diego (0.7 percent), which all exceed the national average for rent growth.

The Southern markets that have shown significant year-over-year rent growth, like Louisville and Washington, D.C., all fall geographically and economically close to the Midwest or Northeast, as mature markets that have seen a relatively healthy supply–demand balance.

Markets with greatest rent increases

| Local market | Year-over-year change in asking rent | Region |

1 | Louisville, KY | 3.6% | South |

2 | Northern New Jersey, NJ | 3.5% | Northeast |

3 | Cleveland, OH | 3.2% | Midwest |

4 | Norfolk, VA | 3.1% | South |

5 | Cincinnati, OH | 2.9% | Midwest |

6 | Washington, DC | 2.8% | South |

7 | Kansas City, MO | 2.7% | Midwest |

8 | Chicago, IL | 2.7% | Midwest |

9 | Indianapolis, IN | 2.7% | Midwest |

10 | Orange County, CA | 2.6% | West |

Want more multifamily insights?

Join CoStar’s Jay Lybik for a recent analysis of the multifamily conditions for 2024. Watch now (click the CC buttons for captions):

CoStar is the industry-leading source for information, analytics, and news about all areas of commercial real estate. Whether you’re an owner, investor, or apartment operator, you’ll find in-depth analysis from Jay Lybik and other experts to help you stay on top of the latest trends in the market. Learn more about CoStar.