After an upward climb that began in 2022, the multifamily vacancy rate stayed stable in the second quarter of 2024. This is one of a few positive signs for the industry revealed in the latest data from CoStar. Despite a near-record delivery of new units this year, the second quarter saw the supply–demand gap begin to shrink. About 180,000 new units were delivered from April through June, but the gap between supply and demand was the smallest seen in 11 quarters.

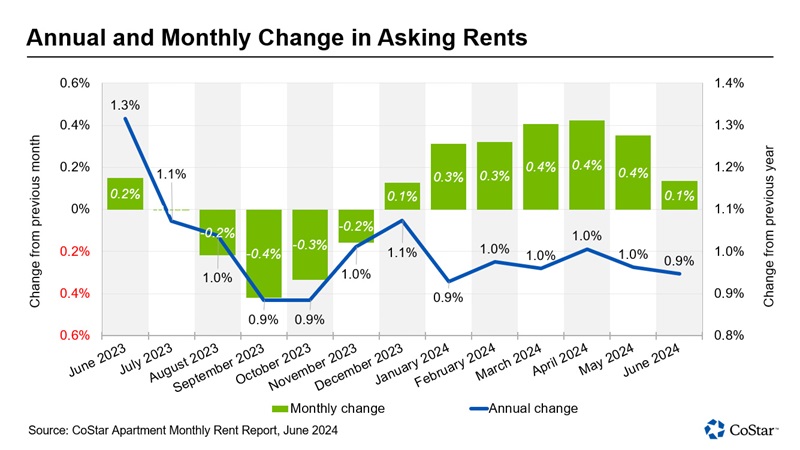

Rent growth has also remained steady, hovering around 1 percent for the last year. June saw the national average asking rent drop slightly to 0.9 percent.

South back in the black, Midwest continues to thrive

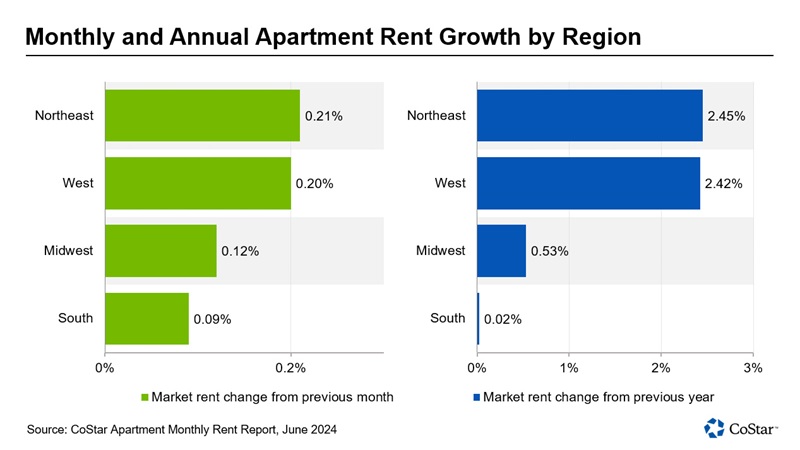

The regional trends of 2023 have continued into 2024, with the Midwest leading rent growth for the nation, with the Northeast close on its heels. The West has remained afloat with minimal rent growth, while the struggling South has emerged from negative territory.

In year-over-year asking rent, the Midwest saw an increase of 2.45 percent, barely ahead of the Northeast’s 2.42 percent. The West saw rents increase by only 0.5 percent, while the South’s 0.02 percent scarcely cracked above zero but was an improvement over the declines seen in the past few quarters. In the first quarter, for example, the South saw asking rents drop by 3.8 percent.

All regions saw rents increase from May to June, though the increases were minimal across the board. The Midwest posted the highest increase (0.21 percent), only slightly ahead of the Northeast at 0.20 percent. The West saw asking rents increase by 0.12 percent, and rents in the South increased month over month by 0.09 percent.

Louisville leads the pack, while Austin trails the nation

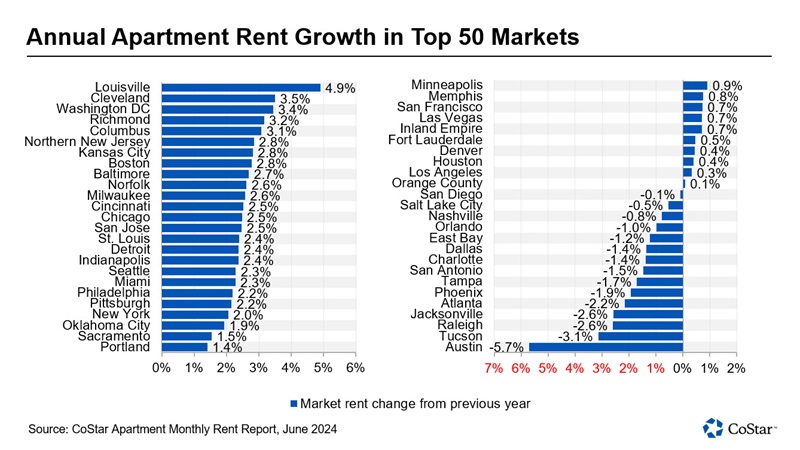

At the individual market level, Louisville took the #1 spot for year-over-year rent growth, posting a 4.9 percent increase in asking rents. Cleveland and Washington, D.C. followed at a distant second and third, at 3.5 and 3.4 percent, respectively. Richmond (3.2 percent) and Columbus (3.1 percent) rounded out the top five.

At the other end of the spectrum, Austin saw rents drop by a whopping 5.7 percent. The other struggling markets in the bottom five included Tucson (-3.1 percent), Raleigh (-2.6 percent), Jacksonville (-2.6 percent), and Atlanta (-2.2 percent). All five bottom performers are in the Sun Belt, where supply has dramatically outpaced demand since 2022.

Join CoStar’s Jay Lybik to explore what’s behind the region- and market-level trends. Watch now:

Demand creeps upwards across all quality classes

Absorption rose across the board, with the greatest total within the four- and five-star property class, where the majority of new supply has been concentrated. Just over 123,000 luxury units were absorbed in the second quarter. Thanks to the abundance of new supply, rent growth in this class was meager, at just 0.2 percent by the end of June.

Mid-priced properties, known as three-star properties in the CoStar building rating system, saw net absorption rise from 33,000 units in the first quarter to 43,000 in the second quarter. This boost helped rent growth rise to 1.5 percent.

At the bottom end of the market, one- and two-star properties recovered from two years of negative rent growth, as households responded to improving consumer conditions. The lowest price point saw absorption of nearly 6,000 units.

Mildly positive outlook for the second half of 2024

Looking ahead to the third and fourth quarters, what market trends should apartment owners and operators expect to see? The high levels of new supply, which hit a 40-year peak last year, are pulling back slightly but will remain elevated, while the trends that have seen three-star properties, Midwest markets, and Northeast markets outperform the national average are expected to continue.

Want more multifamily insights?

Dive into the data from the second quarter with CoStar’s Jay Lybik. Watch the latest state of the market webinar now (click on the CC button to turn on closed captioning):

CoStar is the industry-leading source for information, analytics, and news about all areas of commercial real estate. Whether you’re an owner, investor, or apartment operator, you’ll find in-depth analysis from Jay Lybik and other experts to help you stay on top of the latest trends in the market. Learn more about CoStar.