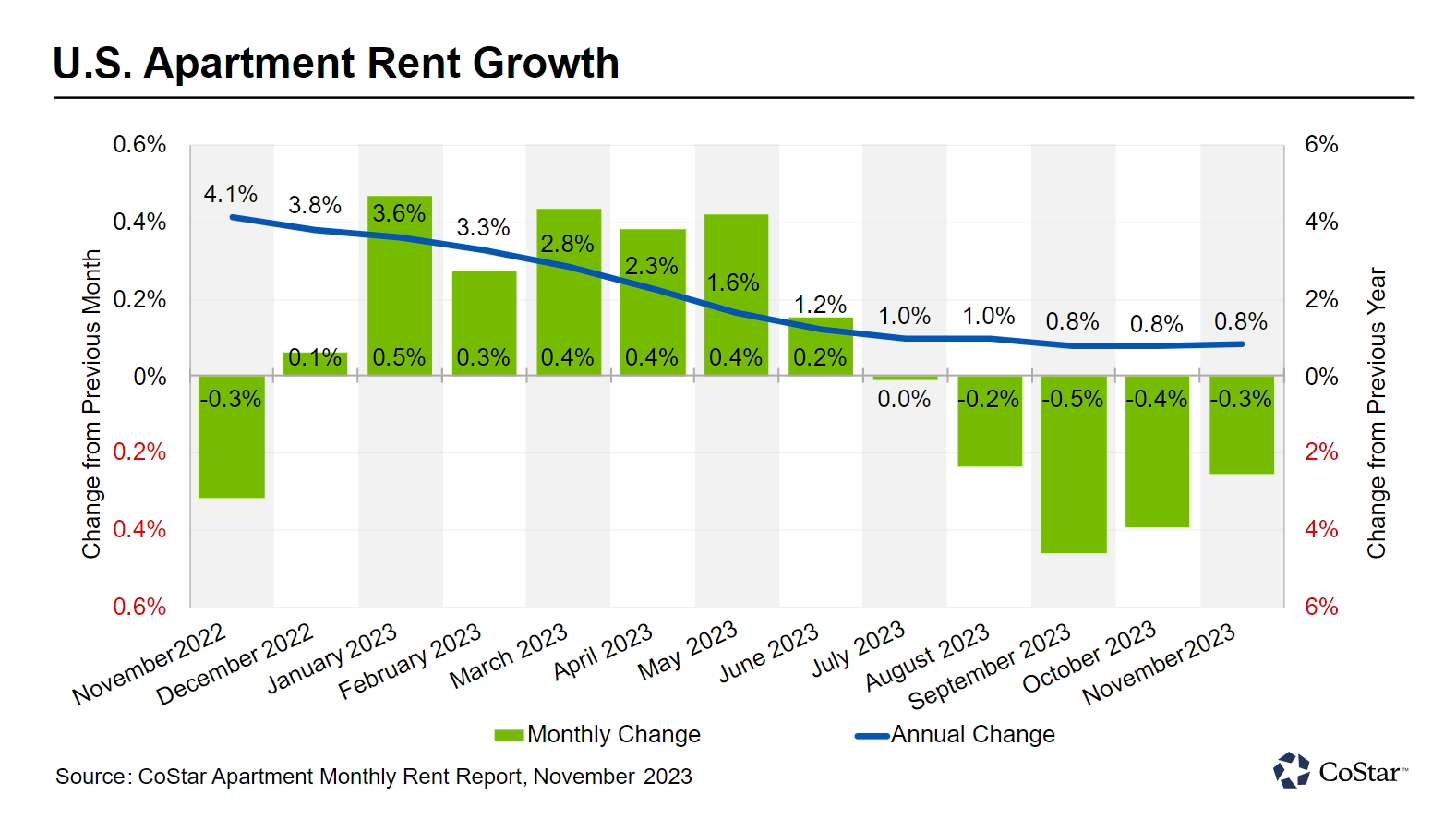

Asking rents fell by 0.3 percent in November compared to the previous month, according to the latest November data from CoStar. This latest news establishes a four-month trend of falling rents as supply continues to outstrip demand. Year-over-year rent growth is at 0.8 percent, with annual rent gains slowing by more than 300 basis points compared to the past year.

Apartment rent growth continues downward trend

From 4.1 percent only a year ago, year-over-year growth in asking rent has fallen to 0.8 percent as of November 2023.

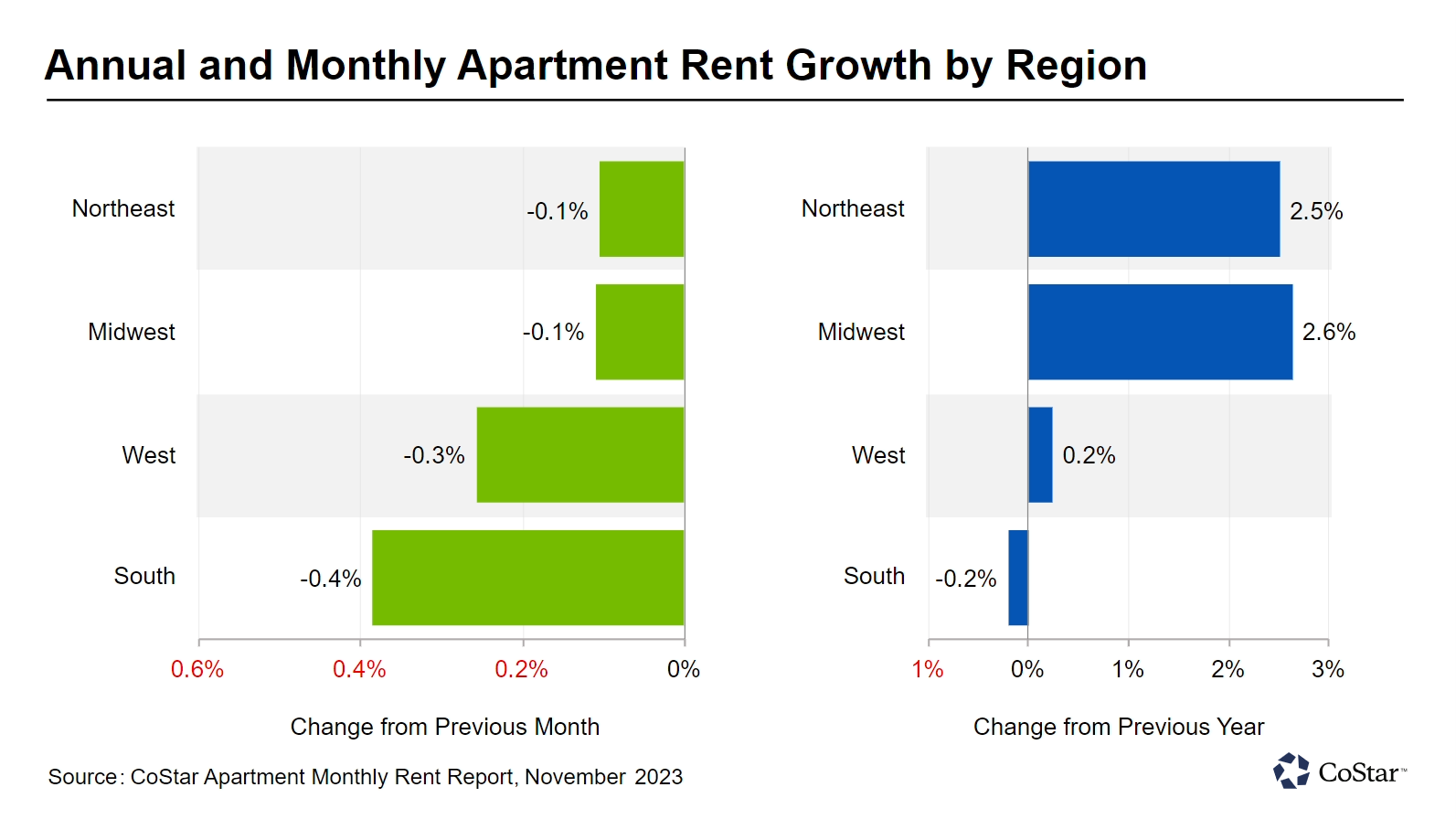

West and South fall behind as Midwest and Northeast come out ahead

Rent growth saw the steepest declines in markets in the West and South, continuing a regional trend in which these formerly hot markets have been hardest hit by the imbalance of supply and demand.

The Midwest and Northeast, which have been driving rent growth this year, saw the smallest losses month over month and continue to post the highest year-over-year rent growth in the country.

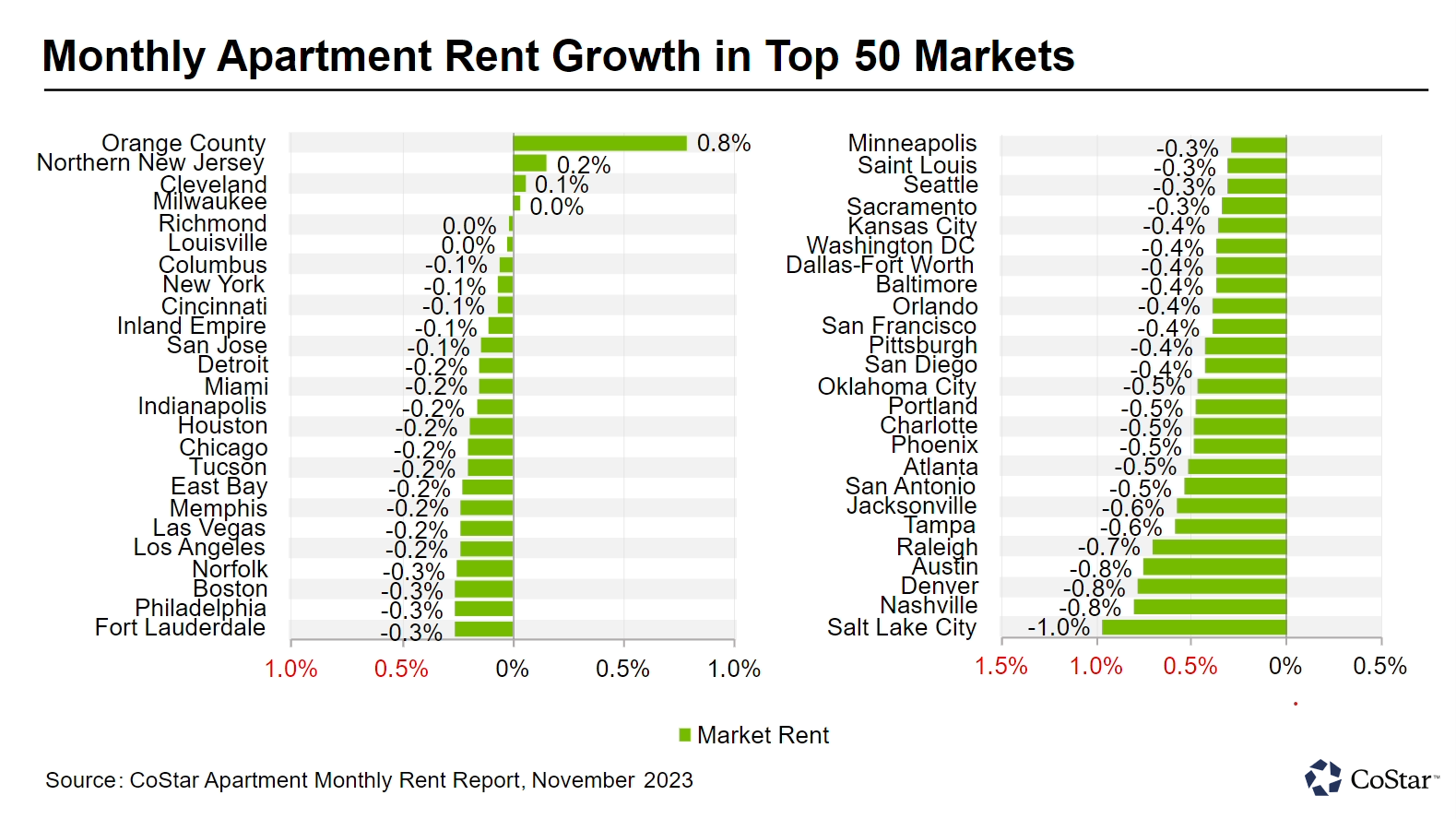

Only 4 local markets see monthly rent increases

In the top 50 markets nationwide, month-over-month rent growth dropped into negative territory. The four exceptions where rents saw modest but positive growth were Orange County (0.8 percent), Northern New Jersey (0.2 percent), Cleveland (0.1 percent), and Milwaukee (just under 0.1 percent).

In recent months, Orange County has seen an enviable combination of relatively high rent growth and high asking rent per square foot.

At the same time, the five markets with the greatest monthly decreases in rent asking rent were Salt Lake City, Nashville, Denver, Austin, and Raleigh, where decreases spanned from negative 1.0 percent to negative 0.7 percent.

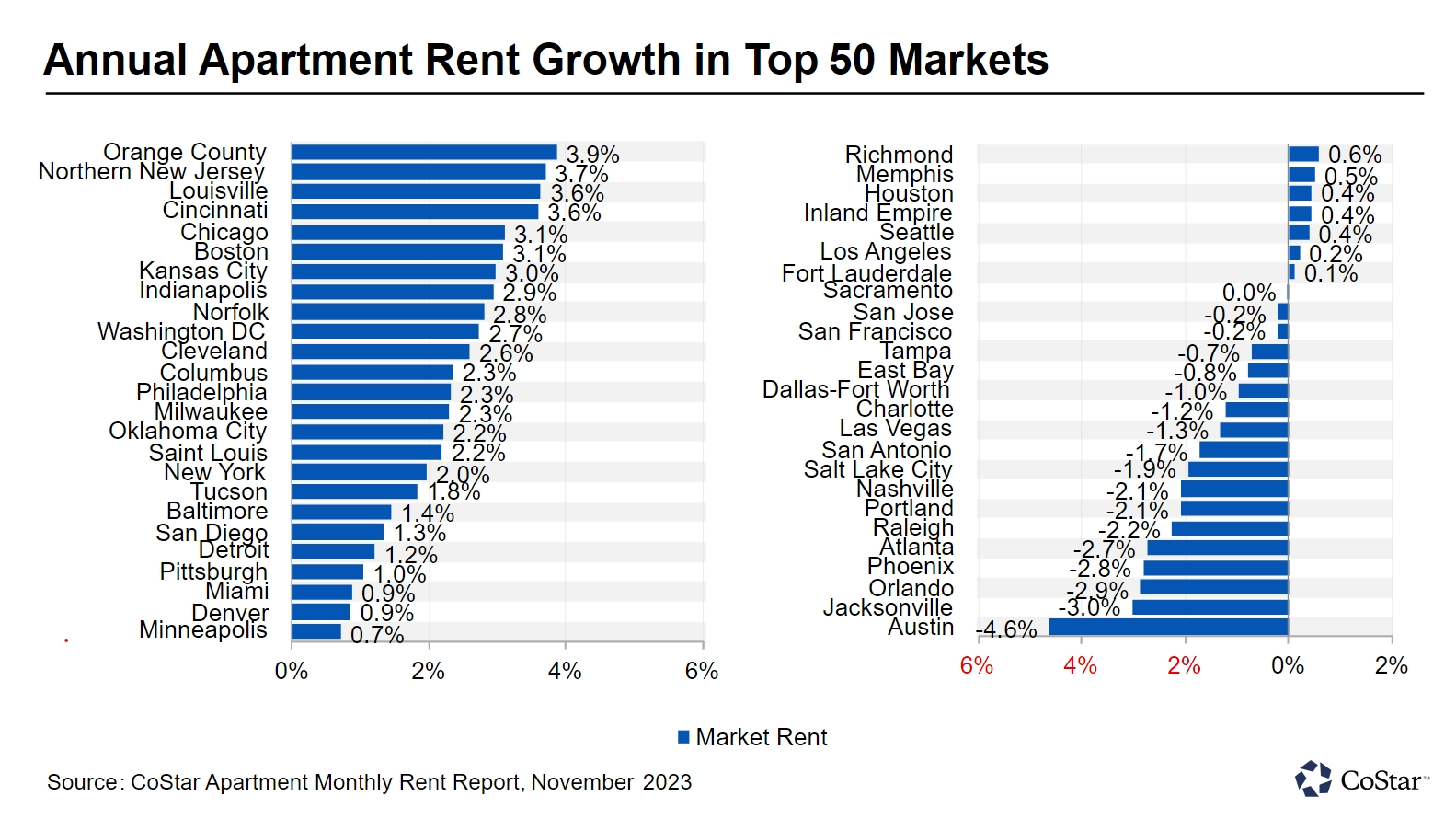

Year-over-year rent growth remains mostly positive

Zooming out to the annual view, rent growth has stayed positive in the majority of the top 50 markets nationwide, with negative rent growth primarily concentrated in Sunbelt markets. Inundated with new supply, markets in the South, such as Austin, Jacksonville, Orlando, Phoenix, and Atlanta, have seen the greatest year-over-year rent declines.

At nearly 4 percent, Orange County leads the nation in highest year-over-year rent growth, consolidating its position as a leader for 2023. This California market is followed by leading markets from the Northeast and Midwest: Northern New Jersey (3.7 percent), Louisville (3.6 percent), Cincinnati (3.6 percent), Chicago (3.1 percent), and Boston (3.1 percent).

Looking for more multifamily insights?

Check out the latest analysis of the multifamily market from CoStar experts Jay Lybik and Christine Cooper. This 10-minute webinar is available on demand and explores the national and regional trends in rent growth, demand, and supply.

Watch now: