Long considered a highflyer in the multifamily industry, the Sun Belt region has fallen to the bottom of the pack in recent quarters. Facing high supply, low demand, and flat or declining asking rents, multifamily markets in the Sun Belt still have a tough time ahead. Here’s why recovery will be slow and what owners and operators should expect.

From leader to laggard: The Sun Belt’s unusual position in today’s multifamily landscape

Known for its sunshine, population growth, and investment-friendly environment, the Sun Belt region of the United States has long been popular among multifamily developers and investors. The region stretches across the Southern United States, encompassing states including Nevada, Arizona, Texas, Florida, and North Carolina.

The most populous markets in the Sun Belt include Dallas-Fort Worth (8.3 million), Houston (7.6 million), Atlanta (6.3 million), Phoenix (5.1 million), and Tampa (3.4 million), according to CoStar data.

But despite its reputation as a solid investment for multifamily developers, the Sun Belt has begun losing its shine in recent years, as supply has overwhelmed demand and rent growth has plummeted.

The second quarter saw traditionally high-performing markets, from Austin to Charlotte, with asking rents lower than they had been a year prior. All 10 bottom-performing markets were in the Sun Belt, continuing a dismal trend.

In Austin, rents dropped by 5.7 percent, according to Q2 data from CoStar. Joining the Texas capital among the lowest performing markets for rent growth were Sun Belt markets Tucson (-3.1 percent), Raleigh (-2.6 percent), Jacksonville (-2.6 percent), and Atlanta (-2.2 percent).

At the same time, markets not typically known for rent growth have soared to the top of the rent growth charts. The second quarter of 2024 saw Louisville rise to the #1 spot in year-over-year rent growth, with a 4.9 increase in asking rents. Louisville was followed by Cleveland. The Midwest has led rent growth since 2023, with the Northeast close on its heels.

“I never thought I would stand in a crowd like this and say that Louisville is the rent growth leader in the United States,” said Jay Lybik, CoStar’s national director of multifamily analytics, during a presentation at this year’s NAA Apartmentalize conference. “That’s just shocking.”

The supply picture

What’s behind this strange reversal of multifamily fortunes? One key element is the massive wave of supply that has hit markets in the Sun Belt. Multifamily construction reached a record high last year, with 1.1 million units under construction in the first quarter, a peak not seen since the 1970s.

And the total for this year remains high. Just under 1 million — 929,000 units — were under construction in the first quarter, according to CoStar data, and tens of thousands of new units have flooded the market.

This supply has been unevenly distributed, with metros like Austin, Nashville, and Charlotte absorbing a high percentage of new supply relative to their population size and total inventory, according to CoStar data. For example, in the first quarter of 2023, Austin saw a whopping 54,000 multifamily units under construction — 20 percent of its total inventory at the time.

The Sun Belt had been a favored region for years among multifamily investors. But the COVID-19 pandemic accelerated the trend towards the Sun Belt. The region was a top destination for renters fleeing more expensive areas of the country, and in turn this in-migration spurred new development. All 11 of the top metropolitan areas that received the highest percentage of net migrants as a percent of their 2020 population were in the Sun Belt, according to the Austin Chamber of Commerce.

The Austin metro was one of the strongest illustrations of this shift. During the first years of the pandemic, the Texas capital and surrounding area saw its population skyrocket by nearly 100,000 people, or over 4 percent of its 2020 population, according to the Austin Chamber. At the same time, major employers such as Oracle and Tesla shifted their headquarters to Austin, relocating from California’s San Francisco Bay Area.

Largest relative increase in population by metropolitan statistical area, 2020–2022

- Austin, TX

- Raleigh, NC

- Jacksonville, FL

- Dallas-Fort Worth, TX

- San Antonio, TX

- Charlotte, NC

- Tampa, FL

- Orlando, FL

- Phoenix, AZ

- Houston, TX

- Atlanta, GA

Thanks in part to the delayed timeline between initial development in a multifamily project and completion of new units, new supply has continued to deliver in the Sun Belt, well after the wave of in-migration has slowed.

And the construction pipeline continues to be strong. In the second quarter of this year, six of the 10 major markets with the highest number of construction starts by total number of units were in the Sun Belt: Dallas-Fort Worth, Phoenix, Miami, Atlanta, Charlotte, and Fort Lauderdale.

The demand picture

The flood of new supply looks like the clear culprit for the Sun Belt’s woes. But low demand has also contributed to the imbalance in the market, driving down asking rents. And it’s not just that demand is low in light of the supply spike.

“There’s this myth in the multifamily space that Sun Belt markets are seeing outsized demand, especially relative to their pre-pandemic levels,” said Lybik in a recent analysis of rent growth trends, “and that's not true.”

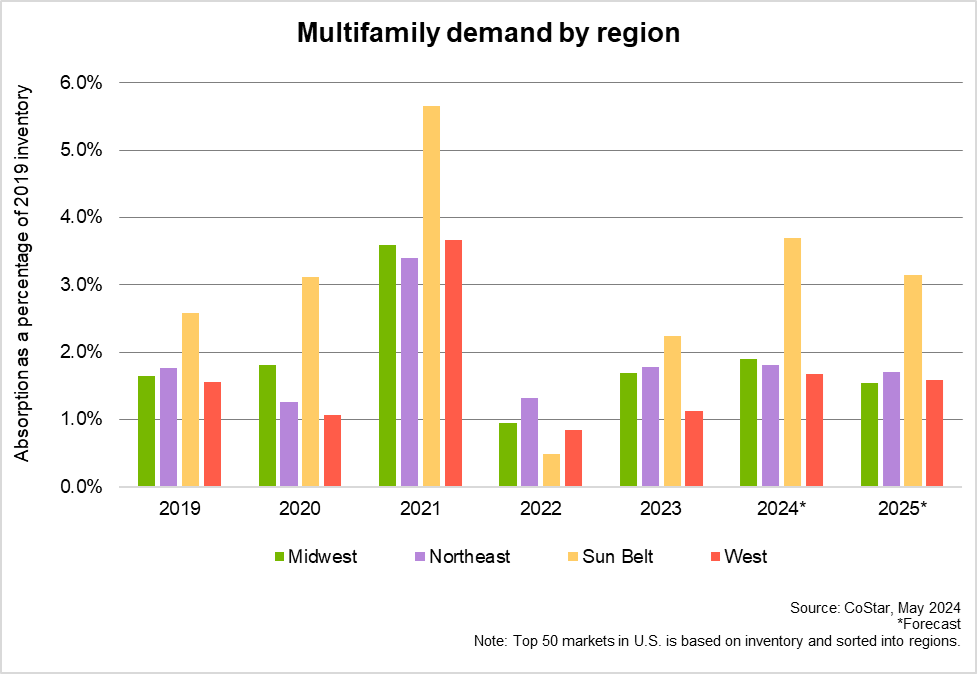

In fact, current demand in the Sun Belt has fallen even relative to pre-pandemic demand, when supply was significantly lower. As a share of 2019 inventory, absorption in the Sun Belt spiked in 2021 but remained below pre-pandemic levels through 2022 and 2023. In 2022, this metric fell dramatically below that of any other region, constituting less than half the same percentage for the Northeast.

Last year, Sun Belt demand began to creep back up, rising above the other regions but still not meeting the absorption seen in 2019 or 2020.

Even as demand is projected to spike in the Sun Belt this year, it will continue to be swamped by high supply. And the outlook for next year remains challenging.

“By the time demand for apartments across the Sun Belt region is forecast to match supply in 2025,” said Lybik in an analysis for CoStar News, “the region will have added 307,000 more units than were absorbed since 2022, a hefty overhang of units to soak up before the region can be expected to return to equilibrium and allow for meaningful rent growth to return.”

Rent growth hovers in negative territory

The dangerous combination of high supply and low demand has driven rent growth in the Sun Belt into retreat. Among the major markets in the country, all 10 of the bottom performers are in the Sun Belt, according to CoStar projections for the third quarter.

Greatest rent growth declines among major U.S. markets (Q3 2024)

- Austin, TX (-4.4%)

- Raleigh, NC (-2.8%)

- Jacksonville, FL (-2.2%)

- Phoenix, AZ (-1.8%)

- Tampa, FL (-1.3%)

- Atlanta, GA (-1.1%)

- Dallas–Fort Worth (-1.1%)

- Charlotte, NC (-1.0%)

- San Antonio, TX (-0.9%)

- Tucson, AZ (-0.8%)

Far behind any other market, Austin brings up the rear with negative 4.4 percent rent growth.

Spotlight on Austin: From double-digit rent growth to record declines

With the lowest rent growth in the country, Austin represents the greatest supply-demand challenges of any market in the oversupplied Sun Belt. How did the situation grow so dire?

During the pandemic, new residents flocked to the Texas capital and its surrounding suburbs. The Austin metro is known for its vibrant music, creative cultural scene, and emergence as a tech hub.

Thanks to its low cost of living, limited taxes, and pro-business environment, the metro has over the years caught the eye of technology leaders such as Apple, Dell, IBM, Oracle, Samsung, and Tesla. Between 2020 and 2022, the Austin metro added over 121,000 people, attracting new residents from Houston, Dallas, Los Angeles, the San Francisco Bay Area, and other metros around the country.

Multifamily development soared, doubling from 2020 to 2022. Under-construction units peaked in the first quarter of 2023, with over 54,000 units, or over 20 percent of total inventory.

Other factors contributing to Austin’s rapid multifamily growth include a higher-than-average permitting rate, ample land for development, and a higher-than-average rate of renters to homeowners.

After a 12-year streak as the fastest-growing metropolitan area, the Austin metro shifted into second place by 2023. Today, it still remains a top destination for in-migration, but demand has been dwarfed by supply, driving the highest multifamily vacancy rate in the nation: 14.9 percent.

In 2025, Austin is projected to have the largest supply decline in the nation, as the market adjusts to the imbalance.

Interestingly, Austin is one of the few markets in which it is not just luxury apartments (known as four- and five-star properties in the CoStar building rating system) are facing steep rent declines. Their mid-priced cousins, known as three-star apartments, have seen an even greater drop, of over 5 percent.

The bright spots in the Sun Belt

Six major markets in the Sun Belt have remained positive, seeing their asking rents increase year over year, according to the CoStar projection for the third quarter. Only two — Oklahoma City and Miami — outperformed the national average of 1.4 percent.

With 2.9 percent rent growth projected for the third quarter, Oklahoma City leads major Sun Belt metros for rent growth and outperforms the national average, with double the national rent growth. The Oklahoma metro, which falls only a hundred miles from the Midwestern state of Kansas, has enjoyed stable demand and only modest increases in supply. With a low cost of living and an increasingly diversifying economy, the Oklahoma City market is expected to maintain stable demand into 2025.

Two Florida markets have also weathered stormy conditions. Miami (2.3 percent) and Fort Lauderdale (1.1 percent) have emerged in the Sun Belt’s #2 and #4 spots for rent growth. These two markets have seen growing demand for luxury apartments, helping meet their high supply pipelines.

Greatest rent growth among major Sun Belt markets (Q3 2024)

- Oklahoma City, OK (2.9%)

- Miami, FL (2.3%)

- Houston, TX (1.2%)

- Fort Lauderdale, FL (1.1%)

- Memphis, TN (0.9%)

- Las Vegas, NV (0.7%)

The outlook for 2024 and 2025

After the rocky last few years, what’s ahead for multifamily in the Sun Belt? The outlook for the quarters and years ahead offers some promising signs, but recovery is expected to be slow.

The rising cost of development will slow construction starts, and supply is projected to drop next year in most Sun Belt markets, offering some relief.

Rent growth for the region overall is projected to lag behind the other three regions throughout the rest of 2024 and into 2025. But by the third quarter of next year, rent growth is expected to turn positive, and the regional differences in rent growth are expected to shrink by the end of 2025.

Projected regional rent growth for Q4 2025

- Midwest: 4.1%

- Northeast: 3.4%

- West: 3.8%

- Sun Belt: 3.3%

Sun Belt markets will be the slowest to recover to positive rent growth. Of the 17 major Sun Belt markets, 14 are not expected to meet or exceed their pre-pandemic five-year average for rent growth by the end of the year.

How the 2024 rent growth forecast compares to the five-year pre-pandemic average

Sun Belt market | Pre-pandemic average | 2024 forecast | Absolute change |

Austin | 3.00% | -2.70% | -5.70% |

Phoenix | 5.70% | 1.40% | -4.30% |

Tampa | 4.10% | -0.10% | -4.20% |

Atlanta | 4.40% | 0.40% | -4.00% |

Raleigh | 3.50% | 0.00% | -3.50% |

Dallas-Fort Worth | 3.50% | 0.30% | -3.20% |

Jacksonville | 3.90% | 1.00% | -2.90% |

Charlotte | 3.50% | 0.70% | -2.80% |

Orlando | 4.30% | 1.80% | -2.50% |

Palm Beach | 3.60% | 1.30% | -2.30% |

San Antonio | 2.30% | 0.00% | -2.30% |

Las Vegas | 5.60% | 4.20% | -1.40% |

Nashville | 3.30% | 2.80% | -0.50% |

Houston | 1.60% | 1.50% | -0.10% |

Fort Lauderdale | 3.10% | 3.40% | 0.30% |

Memphis | 3.20% | 3.60% | 0.40% |

Miami | 2.40% | 3.70% | 1.30% |

Only Fort Lauderdale, Memphis, and Miami are expected to see rent growth above their pre-pandemic five-year averages.

Delve further: Recommended resources

- State of the U.S. Multifamily Market: Q1 2024

- How Long Will Apartment Oversupply Continue?

- Multifamily Vacancy Stabilizes in Q2, As Demand Rises

- Rent Growth: Winners and Losers

- Top 10 Multifamily Markets Facing Largest Rent Declines

Explore CoStar for more multifamily insights

CoStar is the industry-leading source for information, analytics, and news about all areas of commercial real estate. Whether you’re an owner, investor, or apartment operator, you’ll find in-depth analysis from Jay Lybik and other experts to help you stay on top of the latest trends in the market. Learn more about CoStar.