Tenant screening is the process of evaluating prospective tenants and is an essential part of finding the right tenants to rent your property. It aims to determine the likelihood that the tenant will be a good fit for you and your property, whether it's a separate home or a room for rent. As a landlord, you’ll want a tenant who abides by the lease, pays rent on time, and treats your rental property carefully. Properly screening tenants is the best preventive measure you can take to avoid any negative scenarios in the future, such as property damage or missed rent payments. The apartment screening process includes:

- Requesting an application

- Complying with fair housing laws

- Running a background check

- Checking criminal record

- Checking rental history

- Running a credit check

- Checking employment history

- Requesting proof of income

How to Screen Potential Tenants

You can screen a potential tenant several ways, either on your own, with the help of a property manager, or by using tenant screening on Apartments.com. With Apartments.com Rental Tools, you can see the tenant’s eviction, criminal history, and credit history. Regardless of your chosen method, the tenant screening process can be simple and effective if you take the right steps.

1. Request an application

If a tenant shows interest in your property, the next step for them would be to fill out an application. Tenant applications are important because they provide information about your potential renter. If your property is listed on Apartments.com, renters can fill out and submit an application online directly from your listing. A rental application will require certain information from the potential tenant, including:

- Contact information

- Current and previous employers

- Income

- Type and number of pets (if applicable)

- Employer and/or landlord references

2. Comply with Fair Housing

To avoid discrimination, you must conduct tenant screening in compliance with fair housing laws. This means ensuring that the screening process does not discriminate based on race, color, religion, sex, national origin, disability, or familial status. By properly conducting screening and selecting tenants based on objective criteria, you can reduce the risk of legal troubles associated with discrimination. If you use Apartments.com, you can rest assured that the screening process follows fair housing laws.

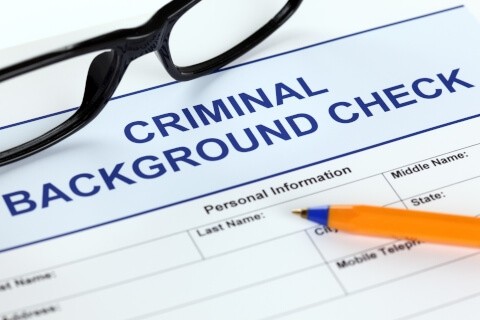

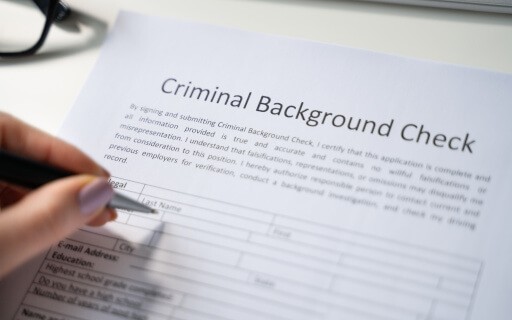

3. Run a background check

A background check is a critical part of the tenant screening, as it gives you a detailed report on the tenant and their past. You can either order a background check yourself or list your rental on Apartments.com and receive extensive, reliable background checks that include criminal and eviction reports from TransUnion. When running a background check, you may need to evaluate the tenant further if you find any prior evictions, a lengthy or serious criminal record, or any legal battles, especially if the tenant was sued for not paying rent or damaging the property.

4. Check criminal record

On Apartments.com, a detailed criminal report from TransUnion will accompany your background check, but you may also request a tenant’s criminal record with your own background check if you haven’t listed your property yet. Knowing an applicant’s criminal history is vital to ensure the safety of yourself, your property, and other tenants/neighbors. Although a clean criminal record is ideal, you should mostly be concerned with felony charges. Keep in mind the duration of time that has passed since the charge or completed sentence as well. If you are uncertain of a tenant based on their criminal record, you can request that they provide you with several reliable references to prove their credibility. If the applicant has a criminal history, you cannot deny them unless the crime jeopardizes the safety of your property.

5. Check rental history

Like criminal records, eviction history is also included with online tenant screening through Apartments.com. Checking a tenant’s full rental history is one of the most important parts of tenant screening because it allows you to see what kind of tenant they’ve been in the past. If you didn’t request their previous landlord’s contact information or a landlord reference on the application, you should consider doing so before approving their application. A landlord reference letter or even a quick phone call with the landlord or property manager can go a long way. It’s helpful to get their opinion on the tenant in terms of paying rent on time, leaving the unit in good condition, and abiding by the terms of their lease. If there is, in fact, an eviction in their past or a lengthy record of not paying rent or other fees on time, you may find it necessary to request more references, require a co-signer, or decline the tenant’s rental application.

6. Run a credit check

Although a background check and a full credit check are available to landlords with tenant screening through Apartments.com, if you are running checks yourself or with the help of a property manager, you will likely need to run a separate credit check. A credit check typically just provides the applicant’s credit score, whereas a full credit report provides a more detailed account of the applicant’s credit history, going back as far as 10 years. As a landlord, you should look for late payments, overcharging accounts, or any other financial mishaps, especially those as serious as bankruptcy. A full credit report will give you insight into a renter’s financial situation. It’s a red flag if they have maxed out credit cards, large loans, or any unpaid balances.

7. Check employment history

When a renter fills out a rental application on Apartments.com, they can provide their employer and supervisor’s contact information. If this isn’t enough information, you should ask for proof of income and references. It’s important to verify that a tenant has a steady, reliable source of income as it shows they are reliable and can pay rent before you accept their application. If they jump from job to job (after possible firings) or have been unemployed for an extended amount of time, there may be reason to hesitate to approve their application. However, keep in mind that there may be extenuating circumstances, such as furloughs, lack of job opportunities, etc., happening in the current climate. If you feel their employment history isn’t reassuring enough on its own, you can either request that the tenant find a co-signer (or guarantor) or provide you with employment references if they haven’t already.

8. Request proof of income

Proof of income can be in the form of bank statements, pay stubs, or even new job offer letters, typically requested from the last three pay periods (differing depending on whether the applicant is paid weekly, bi-monthly, or monthly). Landlords have different requirements for rent, but a common rent requirement is that tenants must make at least three times the rent. If there is more than one applicant on the lease, then this requirement means that all of the applicants’ total income would need to equal at least three times the rent rather than being based on individual income. If the applicant(s) cannot prove they have a steady income that meets your requirements to rent, they probably won’t be the best fit for your rental property. If you choose to rent to them anyway, you can always require them to find a cosigner or guarantor to sign the lease with them before you approve their application.

The Benefits of Tenant Screening with Apartments.com

Tenant screening is the best way to find the right tenant for your property, and with the help of Apartments.com, you’ll receive an all-in-one suite of property management tools that make the rental process simple. From receiving applications and screening tenants from your dashboard to creating and signing leases and accepting and managing payments online, we have you covered.

At no additional cost to you, these tools will help you get all the information you need to screen applicants and make an informed decision. You’ll receive comprehensive credit reports and extensive, reliable background checks from TransUnion for every applicant you choose to screen. Apartments.com makes the tenant screening process simple for everyone, whether you are an individual landlord or a property manager. If you’re ready to get started with tenant screening, take the leap and list your rental property with Apartments.com.

FAQ

What is the screening process for apartments?

The screening process for apartments is like the process for other rentals. When considering tenant screening criteria, you can include requesting an application, running tenant screening, getting proof of income, and more.

What do applications and screening reports look like on Apartments.com?

The screening results for apartments include the application, credit report, background check, criminal report, and eviction report.

How long does tenant screening take?

The time varies as it depends on how quickly the applicant applies as well as how long it takes for you to verify and check all the information provided. The background check and credit checks can also take time to complete. An all-in-one online application and credit check system like Apartments.com Rental Tools can speed up the process.

How extensive are background checks for apartments?

Tenant background checks provide information about potential tenants so that you can minimize your risk when renting. Background checks show a credit report, employment verification, ResidentScore, proof of income, criminal history, and rental and eviction history.

This article was originally published on November 6, 2020.