Whether you’re a novice in the field or an experienced landlord, you must have access to data about your rental property and tenants. From the rent you’ve collected to the payments overdue, these are details you’ll need available for review and to help you make practical decisions regarding your investment.

Without a doubt, there are many documents you will need to file for safekeeping. While ciphering through them all can be challenging, a rent roll form can help you consolidate pertinent information about your property and tenants into one convenient document. Save yourself the stress and discover why this valuable resource is so handy.

Table of Contents:

- What Is a Rent Roll?

- How Does a Rent Roll Work?

- Why Is a Rent Roll Important?

- How Do Buyers Use a Rent Roll?

- How Do Landlords Use a Rent Roll?

- How Do Lenders and Tax Collectors Use a Rent Roll?

- How to Create a Rent Roll

- What Should a Rent Roll Include?

- Rent Roll Example

- When Should I use a Rent Roll?

- Where Can I Find Rent Roll Data?

What Is a Rent Roll?

A rent roll is an itemized report of income generated from each unit in a rental property. The statement includes how much rent a tenant owes each month, the rent you’ve already collected, and any overdue payments a tenant may have on their account. While there are many forms you need to have as a landlord, the rent roll outlines important information, allowing you to view data relevant to a tenant’s rent and the investment value of a rental property.

How Does a Rent Roll Work?

A rent roll works by organizing the total rent amount for the entire property. This document compiles information from the lease agreement and can cover one property or a complete portfolio of rental units. Typically, a landlord or property owner might have to gather information from varying sources, but the rent roll form provides a one-stop-shop for all that data.

In addition to a rent roll, you can easily keep track of rent payments and late fees when you collect rent with Apartments.com. Set up automated rent payment reminders, late fees, and allow your tenants to pay with various methods.

Why Is a Rent Roll Important?

A rent roll form is crucial because it serves as historical evidence showing your tenants’ rental habits and reliability. For example, you can see tenants who consistently pay their rent late (or not at all) and then use that information to swiftly handle unreliable tenants by sending out a warning notice or filing an eviction.

Having a record of this financial information ensures you can meet the daily operational needs of your property, from scheduling critical repairs to performing building maintenance. Effectively managing your rental property is key to a financially thriving business as a landlord or property owner. This document enables you to make more informed and timely decisions, which is good for profitability.

More than anything, your rental property is an investment that should generate consistent income for you. The rent roll provides a real-time look at your property’s cash flow. Whether your gross rental income is likely to increase, decline, or remain stagnant, your rent roll document can conveniently help you perceive that information.

How Do Buyers Use a Rent Roll

Buyers and sellers benefit from a rent roll because it allows them to assess how much gross rental income a property generates. Contrasting the tenant’s rent with the fair market rent value can help you determine if you can increase the rental value by increasing the rental dues. Sometimes buyers will pay more to buy a rental property if they can see that it can produce a consistent rental income stream.

How Do Landlords Use a Rent Roll

At a glance, a rent roll can inform you about the reputation of a tenant and help you anticipate potential issues with them. For instance, if your tenant starts paying late, that could signify that it will become a regular occurrence. Using the rent roll to guide your decision, you might need to evict the tenant and promptly pre-market the property so you can make repairs and reduce vacancy times.

How Do Lenders and Tax Collectors use a Rent Roll

Lenders and tax collectors utilize a rent roll to evaluate the property’s income potential. If a rent roll shows that the property has a history of generating steady rental income, a lender will be more likely to make a loan than if the property had a history of high vacancy rates or turnover.

Tax collectors use rent rolls to ensure that property owners are adhering to local tax laws.

How to Create a Rent Roll

The simplest way to prepare a rent roll is with a spreadsheet program. You label the rows and columns based on key headers and then input the data you gather from the lease agreement and rent records.

What Should a Rent Roll Include?

The exact contents within this document can vary depending on the property type, but in general, a proper rent roll form should include the following details:

Property details

- Property owner or landlord name

- Property address

- Lot size

- Property type, such as single-family home, multi-unit, condominium, townhome, etc.

- Property zoning, such as residential, mixed-use, rural, urban, and/or suburban

Unit details

- Unit number: This number should be listed for each individual tenant on the rent roll.

- Number of bedrooms and bathrooms: This will help you gauge your rent in comparison to the market price.

- Square footage: Use this number to compare your rent prices to similar units in the area.

- Extra features: Include unique features, like a storage shed, two-car garage, deck, etc.

- Extra amenities: Include swimming pools, proximity to a hiking trail, HOA, etc.

Tenant details

- Tenant’s name

- Monthly rental dues

- Additional rental dues, such as pet fee, parking fee, storage fee, amenities fee, etc.

- Rent due date

- Date tenant paid their rent

- Late or defaulted rental dues

- Previous rental dues

- Advanced rent payments

- Security deposit amount

- Rent concessions

Rental income summary

- Total monthly rent collected: This is the sum of all monthly rents for each unit.

- Total annual rent collected: Multiply your total monthly rent by 12

- Total fees collected from tenants: Will the tenant pay for utilities, maintenance, pest control, carpet cleaning, or landscaping?

- Total additional rental income collected

Rent Roll Example

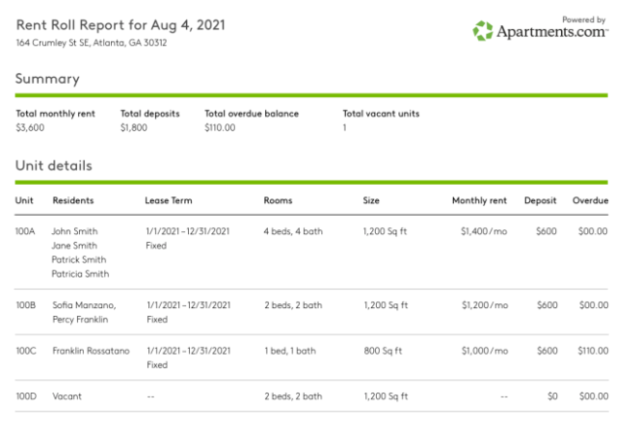

While no two rent roll documents are alike, here is an example of a basic rent roll template. When you list your rental on Apartments.com, you will be able to create your own rent roll document, customized to fit your property.

When Should I Use a Rent Roll?

There are many reasons why a rent roll is beneficial. Here are five relevant instances when you should use a rent roll for managing your rental property.

-

Rent growth — You can compare the monthly records year-over-year to determine if the property’s rental income is increasing, decreasing, or remaining stagnant (and by how much).

-

Tenant renewals and turnovers — A rental property has a 100% turnover rate if the tenants change year-over-year or before the year ends. This is an undesirable outcome because it means more vacancy periods between each new renter, resulting in a cash flow reduction. Use this data to implement realistic solutions, such as improving property management, maintenance, and upgrade efforts.

-

Rent paid on time — Reviewing the rent roll to see how often you receive payments on time indicates the quality of your tenants and the property management firm. You can use this information to determine whether to renew a tenant’s lease agreement.

-

Late fee income — As a landlord or property owner, you might categorize late fees as “found income” or an additional source of rental revenue. You can find this data on the rent roll and use it to discern what percentage of a tenant’s monthly rent equals the late fee cost.

-

Evictions — If a rental property’s rent roll shows the tenants change every year, it would be helpful to know why—whether voluntarily or through an eviction. If the latter, it may be beneficial to understand how much the repair and legal fees were before you rent out the property to a new tenant.

Where Can I Find Rent Roll Data?

There are several sources you can use to pull data for your rent roll, including:

- Your tenant’s lease agreement

- Your tenant’s file

- A county tax assessor

- A Multiple Listing Service (MLS)

- An appraisal report

- A profit and loss statement (P&L)

A rent roll will provide an overview of your property’s past, present and future income potential. With Apartments.com, you can view tenant leases, income statements, overdue balances, and upcoming vacancies to utilize essential information when you need it.