If you are looking for a way to make some money, investing in a rental property can be a good way to do so. However, it is not as simple as buying a property and then leasing it to a tenant. Many steps are involved in all processes, including the purchasing and financing part. Financing a rental property can be challenging, but it is an achievable and realistic goal for those who come prepared.

- Should I buy a rental property?

- Picking a location and property

- Buying a rental property

- Profit

- Property management

Should I Buy a Rental Property?

There are a lot of different factors you should consider before you buy a rental property, as it is a big investment. First, consider what you want to gain from owning a rental. This helps you decide and narrow down what kind of property you want. Ask yourself:

- Do you want this as passive income, or will this be your main source of income? What are your financial goals overall, and how does this investment fit in?

- Do you have the skills, time, and readiness to own and manage a property?

- Do you want a property that needs renovations or a move-in-ready property?

Renting out a room can be a good way to test the waters to see if you want to commit to buying a rental property. However, if you are ready to make the leap, make sure you go in set with all you need.

Picking a Location and Property

Now that you have decided to buy a property, it is time to find one. The best way to start is to figure out what you want. First is location; start by looking at the big picture and then at smaller details. When looking at the big picture, you should consider factors like:

- Risk of natural disasters

- Population growth in the area

- Rental rate/vacancy trends

- Crime

- Market prices

- Property taxes

- Rent vs. ownership

Next, you should look more closely at the specific neighborhood and area you want to buy a property in:

- Neighborhood growth

- Nearby amenities

- Walk score, bike score, and sound score

- Nearby education like schools and universities

- Local transportation

- Employment opportunities

When looking at specific properties, you need to decide if you want a property that needs more work or is mostly ready. When considering properties, look at:

- Yard size/potential yard maintenance

- Age and condition of property

- Needed maintenance/repairs

- Curb appeal

- Ages and conditions of major systems, like HVAC

- Ages and conditions of appliances (if included in the sale)

- Additional property amenities, such as a pool, shed, etc.

Once you’ve found a property, you should have inspections done to ensure everything is in decent order before buying the place. Some important inspections are:

- General home

- Electrical system

- Plumbing

- Foundation/Structural

- Roof

- Vents

- House systems, such as HVAC

- Pest

- Mold

You should also consider if you want to do any renovations/installations that could raise the property value. Depending on your location, renters value amenities such as eco-friendly features, granite countertops, walk-in closets, and more.

Buying a Rental Property

There are a lot of moving components when it comes to financing a rental property. Getting a mortgage is one of the biggest parts; be ready for lenders to scrutinize your finances.

Mortgages

There are many options for how to buy a rental property but be aware rental properties may have higher interest rates and down payments than a primary residence. You should be familiar with the names Fannie Mae and Freddie Mac as you go through the process. These government-sponsored entities buy most of the mortgage loans (including conventional loans) lenders make, allowing lenders to use that money to make more loans. However, Fannie Mae and Freddie Mac have home loan guidelines (such as the required down payment, credit score, or debt-to-income ratio), so lenders structure their requirements to fit those.

Conventional mortgages are the most common type of mortgage. These mortgages come directly from lenders and are not government-backed. Anyone can qualify for these loans if they meet the lender’s standards. There are two types of conventional mortgages:

- Conforming: Conforming loans comply with mortgage loan limits set by the Federal Housing Finance Agency and Fannie Mae and Freddie Mac guidelines. Conforming loans have a maximum dollar limit, which means the house must be near or under that limit. Conforming loans can be easier to qualify for, have lower mortgage rates, lower down payment, and more.

- Non-conforming loans exceed loan limits or are outside Fannie Mae/Freddie Mac underwriting guidelines. These include Jumbo Loans, designed for properties that are more expensive than conforming loan limits. The criteria to get this loan are much stricter, and there might be higher mortgage interest rates.

Besides conventional mortgages, there are non-traditional loans, like FHA loans and VA loans. These can be primarily for owner-occupied properties and have requirements like you must live in the residence for a year or have specifics on who can apply for these loans, making thorough research on the loan essential.

Loan terms

The most common loan terms are 15-, 20-, or 30-year mortgage terms. If you pick a longer loan term, then you might get a higher interest rate with lower monthly payments.

Interest rate types

Mortgages have two kinds of interest rate types: fixed-rate mortgages (FRM) and adjustable-rate mortgages (ARM). FRMs have the same interest rate for the entire loan, whether 30 or 15 years. If you go for an ARM, the interest rate will change depending on the market. This is good and bad as it means you may get a low interest rate to start, but it could rise significantly in the future.

Down payment

The amount you put down affects your mortgage rate. If you give a higher down payment, the lender usually lowers your mortgage rate. Typically, it is around 20 percent, but it can vary. It depends on the kind of mortgage you choose, as some loans allow for lower down payments. Lenders could require mortgage insurance if you choose to make a down payment lower than 20 percent.

Credit score

Depending on what kind of mortgage you choose, the credit score required will be different. For conventional loans, having a credit score of 620 or higher is required but it is best if you have a credit score of around 740. A better credit score means lower interest rates. Lenders look at your credit report to see if there are any red flags.

Debt-to-income ratio

Lenders will calculate your debt-to-income ratio to decide if they should loan to you or not. This shows how much of your monthly gross income goes to pay debts. There are two kinds of DTI:

- Front-end DTI: Look at how much of your gross income goes towards housing costs. Divide the mortgage by monthly income and then multiply by 100 to find the percentage. Typically, lenders want this to be between 28 percent and 35 percent, according to Experian.

- Back-end DTI: Compares gross income to all monthly debt payments. Add up all debt payments and divide by monthly income, then multiply by 100 to find the percentage. You want a lower back-end DTI; Experian says between 36 percent and 43 percent means you are managing debts well.

- For example: If you make $2,000 per month and you owe $1,000 every month, your DTI is 50 percent.

Other qualifications

Lenders can look at employment history and assets to decide if you qualify. Steady employment signals that you will have a reliable income and be able to make payments which will lower your interest rates. Depending on the situation, your assets may also be looked at to see if you have a financial cushion to help pay your mortgage in case anything happens. The location of your property affects your mortgage interest rates too. If it is in an area with a weaker market, it could be considered a higher risk, and lenders charge a higher interest rate because of that.

Profit

When you buy a property, you need to consider expenses and return on investment (ROI). This will tell you how much profit you could make and if this is a good investment by calculating your property’s profit as a percentage of the cost of your investment. A higher ROI means higher profit. You can calculate your ROI on your own or use Apartments.com’s ROI calculator. To calculate your ROI, you will need your cost of investment, monthly expenses, and monthly income and you will use the formula:

- ROI = (investment gain – investment cost) ÷ investment cost

Expenses will include mortgage, insurance, property taxes, maintenance costs, homeowner’s association fees (if there is one), and anything else you would need to spend money on related to the property. A common guideline suggests that 50 percent of your rental income should be set aside for expenses. Regarding maintenance costs, you should estimate about 1 percent of your yearly property value.

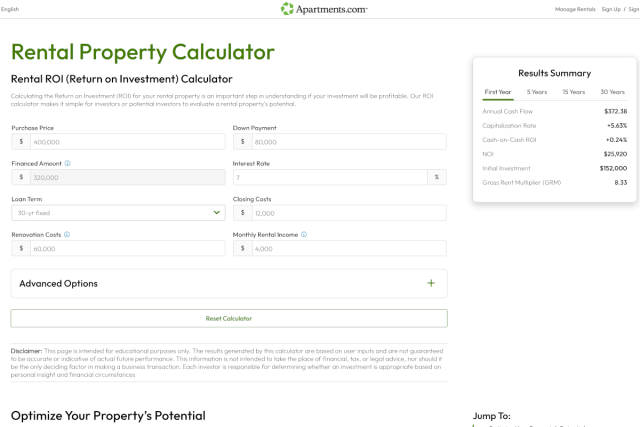

Using the ROI calculator on Apartments.com is easy. Enter your purchase price, down payment, financed amount, interest rate percentages, loan term, closing costs, renovation costs, and monthly rental income. If you want to get into more detail, you can input advanced options, including monthly recurring expenses and yearly growth percent. The results summary will pull up your returns for the first year, five years, 15 years, and 30 years.

The return on investment rental property calculator gives you several ways to assess your rental property’s value as the results include annual cash flow, capitalization rate, cash-on-cash ROI, NOI, initial investment, and gross rent multiplier. Just calculating your ROI is not enough because it only gives one view of your property. So, you should use several methods, and the rental property calculator does those calculations for you. If you need a refresher on the definition of these terms, below the calculator is a section explaining them.

Calculating rent

Another important part of being profitable is being able to calculate the rent for your property. There is no perfect formula telling you how much you should charge for rent. You’ll need to understand market demand and trends, analyze comparable properties, consider property condition and amenities, be familiar with the current economy, and budget for maintenance and utilities. This may seem like a daunting task, but rent comp reports on Apartments.com help you confidently price your rental. Rent comp reports give you all the information you need to make an informed decision.

Property Management

Figuring out how to manage a rental property is the next step. There are two options: managing your own rental property (called DIY (do it yourself) management) or hiring a property manager. When trying to decide if you should hire a property management company, you need to weigh the pros and cons of each option to decide what is best for you. If you don’t want to spend any extra money on a property manager, you could opt for DIY management. However, if you don’t have time to do all the property management responsibilities, then hiring a property manager might be a good decision. Whether you decide to manage the property on your own or hire someone, you still need to know what a landlord is responsible for. While your responsibilities will vary, some common tasks are:

- Managing Tenants

- Tenant screening

- Applications

- Scheduling move-ins and move-outs

- Maintaining the property

- Cleaning

- Landscaping

- Repairs

- Financial Management

- Rent pricing

- Collecting rent and fees

- Handling security deposits

- Taxes

- Keeping track of expenses and income

Laws

Part of owning and managing a rental is understanding all the laws involved, from fair housing laws and credit reporting laws to tenant screening laws and eviction laws. Depending on your location, there may be city and state-specific laws that you must follow. Be sure to thoroughly read and research all laws surrounding rental properties, landlords, and tenants. To become well-versed in local laws, some great resources are your city’s website, realtor associations, non-profits, and more.

This article is not intended as financial advice and should not be construed as such. Before purchasing a rental property, please contact your financial advisor or real estate attorney.

FAQ

How can I find tenants for my rental property?

You can find tenants for your rental property by listing on Apartments.com for free. Apartments.com helps your detailed listing reach millions to fill vacancies fast. It is a quick and effortless process; all you have to do is sign up using your email, give your property’s basic details, and upload some photos. Make sure your listing abides with fair housing laws and other local laws to avoid any complications.

What’s the best way to screen potential tenants?

Save time and effort using Apartments.com for your tenant screening. Once your tenant applies and proceeds through the screening process, their application, eviction reports, criminal history, and credit report will appear on your dashboard. When you screen with Apartments.com, you can rest easy knowing that the proper laws and procedures are being followed. If you decide to screen on your own, research and make sure you are following tenant screening laws, both local and federal.

Should I invest in short-term or long-term rental properties?

Short-term and long-term rentals offer unique advantages and disadvantages and attract different kinds of tenants. Short-term rentals generally have a greater potential to earn money and a higher tenant turnover. You might spend more time screening tenants and reviewing applications in addition to having a less stable source of revenue. Long-term leases are a good choice for those who want consistent revenue and a lower turnover rate. This can mean having a lower rent price to compete with other rentals in your area.

What is the 2% rule for an investment property?

The 2 percent rule is a bit of a niche and outdated way to assess the profitability of a rental property. It says if you make 2 percent of the purchase price from rent each month, then you have made a good investment. Do be aware that this rule is rarely used as each property is different, and the market is constantly changing.

How much monthly profit should you make on a rental property?

There is no set rule on how much monthly profit you should make on a rental property. Most times, landlords use a variety of ways to determine the return on investment (ROI) like cash flow, cash-on-cash return (CoC), capitalization rate (cap rate), net operating income (NOI), and gross rent multiplier (GRM).