As a landlord, you don’t want to let your rental property sit vacant, but you don't want to rush to fill the unit. Properly screen every potential tenant is essential. Leasing your property to the wrong person can be a costly and time-consuming mistake. Evictions, property damage, and disgruntled residents are just a few things that happen when you rent to the wrong tenant. To avoid a future headache and wasted money, it’s essential to properly screen all potential tenants to make sure you’re investing in the right tenant for your rental property.

The Best Way to Screen Tenants

Apartments.com makes it easy to screen tenants, get the information you need, and find a qualified renter fast. Unlike our competitors, who use various third-party resources to collect information, we partner with TransUnion to provide you with screening reports for evictions, credit, and criminal history. Another feature you’ll find only on Apartments.com is support for co-signers, guarantors, and co-applicants. If you need more information to make a decision, you can request supporting documents from potential tenants directly on our platform. Get all the information you need to find the right tenant quickly and easily.

Three Signs for a Low-Risk Tenant

Low-risk tenants are usually the most reliable tenants. People who make at least three times the monthly rent price, have a credit score above 670, and have a glowing rental history are considered low risk.

1. An income three times the price of rent

It’s generally advised that property managers require that residents make at least three times the monthly rent. Landlords in areas that have higher costs of living usually require that tenants make at least four times the monthly rent.

To verify a prospective tenant's income, ask them to provide proof of income with two or three different documents. Pay stubs, bank statements, and W-2 income statements are all common ways for landlords and property managers to get an idea of a person’s monthly take-home pay and spending habits. Renters can use a rent calculator tool to ensure they are applying for a rental that meets this recommendation.

2. A credit score above 650

Even if a potential renter meets the income requirements, you still need to run a credit check on them to ensure that their income matches all their other expenses. Most landlords require a minimum credit score of 650. Any credit score under 579 is considered bad and should wave a red flag. A score between 580-669 is fair, and anything from 670 and above is considered good to excellent.

Running a credit check is your way of verifying that the prospective tenant is relatively debt free, makes their payments on time, and doesn’t spend above their means. Typically, a person with a credit score of 670 and above shouldn’t cause concern.

3. Previous rental experience with positive landlord referrals

One of the biggest indicators of a low-risk tenant is someone with a solid rental history. Ask potential tenants to provide referrals from their past landlords. Landlords and property managers aren’t obligated to answer questions about their past renters, but simple questions about whether they paid on time and were respectful of the property are usually okay

Three Signs for a Medium-Risk Tenant

In an ideal world, every tenant has all the qualities mentioned above. However, not many people meet the perfect criteria, but that shouldn’t discount them as a future tenant. Many renters fall into the medium-risk category. A medium-risk tenant has the potential to be a great tenant, but you’ll want to investigate their shortcomings.

1. Irregular income

People with irregular incomes fall into the medium-risk category. If you see from their proof of income that they only work seasonally, do short-term freelance jobs, or are on a government stipend that is about to end, then you may want to pause and ask for verification that they are able to afford rent for the entire lease. Having irregular income shouldn’t automatically discount someone from your property, but you’ll want to do some investigating to make sure that they will be able to pay monthly rent for the entire lease duration.

2. Spotty credit history

If the prospective tenant is making more than the income requirement, that doesn’t mean they’re in the clear just yet. You still need to run a credit check to verify their debt-to-income ratio. A high income with a credit score between 580-650 or less is concerning. You’ll want to inquire as to why their credit score is in the bad to fair range. If you can see that their credit is consistently climbing and they’re paying off debts, then they may be worth the risk. If you see that they’re missing payments and their score is steadily dropping, be wary. Debts shouldn’t automatically discount someone from renting in your property. Debts like student loans and car payments are normal, but missing payments on maxed-out credit cards and owing money to collection agencies is a cause for concern. They may pose a bit of a higher risk, but if everything else about them checks out, consider requiring them to provide a cosigner or guarantor.

3. No rental history

Tenants who meet the income and credit score criteria could still fall into the medium-risk category if they have no rental history. Verifying someone’s financial situation is a great indicator that they’ll be a good tenant, but it doesn't prove the non-financial qualities of a tenant. Most landlords like being able to verify that a tenant hasn't caused major damages or noise disturbances and that they followed community rules. If a tenant doesn't have a rental history,it’s harder to decide if they will be a reliable tenant. People are new renters for a range of valid reasons. Sometimes, it is worth it to take the risk on a new renter.

Three Signs of a High-Risk Rental Application

Unfortunately, not all prospective tenants meet every requirement. However, we don’t live in a perfect world, so make sure you understand the whole story before denying someone’s rental application. The following things usually classify an application as high risk:

1. Eviction record

Eviction is the word dreaded most by renters and landlords alike. A prospective tenant with a record of eviction should raise a major red flag for landlords. With that being said, don’t completely discount a tenant with an eviction. Look at when the eviction was filed and what their current credit score and income are. If their eviction was over five years ago, they meet the income requirements, are working on past debts, and their credit score is climbing, then the eviction shouldn’t completely disqualify them for your property. Just know that they do pose more of a risk.

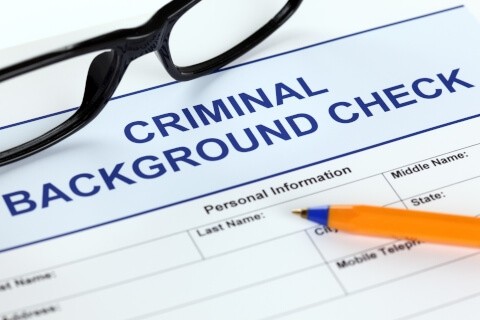

2. Criminal records

If your state allows it, run a criminal background check on all prospective tenants. Criminal information is public record and both serious and minor offenses will be reflected. Ask all tenants for a valid form of identification, so you can run a proper background check on all tenants.

3. Low or no credit score

Prospective tenants with a credit score lower than 650 or with no credit score at all should make you pause and investigate. Again, credit scores are a great indicator of whether someone pays their bills and their debt-to-income ratio. Unfortunately, someone with debts their income can’t support may have some issues paying rent, and someone with no credit score has no way of proving if they make payments on time and in full.

Again, just because they have a low or non-existent credit score doesn’t mean you should automatically disqualify them. If everything else about them checks out, consider charging a higher security deposit or require tenants to have a cosigner or guarantor. The prospective tenant is allowed to help ease your mind as well by offering to pay a few months’ rent upfront.

No Tenant is Risk Free

No tenant screening method is foolproof, but taking steps to identify the risk of potential tenants will help you in the long run. Hopefully, these guidelines help you make the right decision for your rental property. Remember, screening your tenants is allowed and responsible, but you are required to treat every prospective tenant equally and fairly.