Finding the right tenant is the first and most important step in renting out your property, yet selecting someone to take care of your investment can be nerve-wracking. Nobody wants to live out the horror stories – the renter who wouldn't pay, destroyed the property, or wouldn't leave when their lease was up. How do you find someone who will treat your property like their own, respect the lease terms, and pay rent when it's due? A tenant background check is your first step to avoid bad tenants.

What Is a Tenant Background Check?

A tenant background check is a process conducted by landlords or property managers to assess the suitability of prospective tenants before renting out a property to them. This identity verification and screening process involves gathering information about the prospective tenant's past rental history, financial stability, and criminal record, among other relevant factors. The primary goal of a tenant background check is to minimize risks associated with renting out property and to ensure that the tenant you select is likely to fulfill their lease obligations responsibly.

What Are the Risks of Skipping a Tenant Background Check?

Skipping a tenant background check can expose you to a myriad of potential risks, ranging from financial losses to legal liabilities. Here are the significant risks associated with skipping a tenant screening report or conducting inadequate tenant background checks:

-

Financial Losses: Renting to tenants without conducting a background check increases the risk of encountering individuals who may default on rent payments or cause damage to the property. This can lead to financial losses due to unpaid rent, property damages, and potential eviction costs.

-

Property Damage: Inadequate screening may result in leasing to tenants with a history of property damage or neglect. Such tenants may cause extensive harm to the rental unit, necessitating costly repairs and potentially diminishing the property's value.

-

Legal Liabilities: Failing to conduct thorough background checks can expose landlords to legal liabilities and disputes. This includes leasing to tenants with a history of lease violations or engaging in illegal activities on the premises, which can lead to legal battles, fines, or lawsuits.

-

Safety Concerns: Without proper screening, landlords risk renting to individuals with a criminal history or a propensity for violence. This poses a safety hazard not only to other tenants but also to neighbors and the surrounding community, potentially resulting in incidents of harm or property damage.

-

Tenant Disruptions: Inadequate background checks may result in leasing to tenants with a history of disruptive behavior or conflicts with neighbors. This can create a hostile living environment, leading to tenant dissatisfaction, turnover, and difficulties in attracting new tenants.

-

Reputation Damage: Renting to problematic tenants can tarnish the reputation of you as a landlord and the property. Negative experiences may spread through word-of-mouth or online reviews, deterring prospective tenants and impacting the property's occupancy rate and rental income.

Skipping a tenant background check poses significant risks for you as a landlord, including financial losses, legal issues, safety concerns, tenant disruptions, and reputation damage. Thorough and comprehensive tenant screening procedures are essential for mitigating these risks and ensuring the successful management of rental properties.

What Shows Up on a Tenant Background Check?

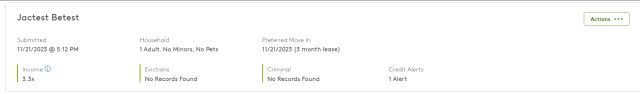

Credit report

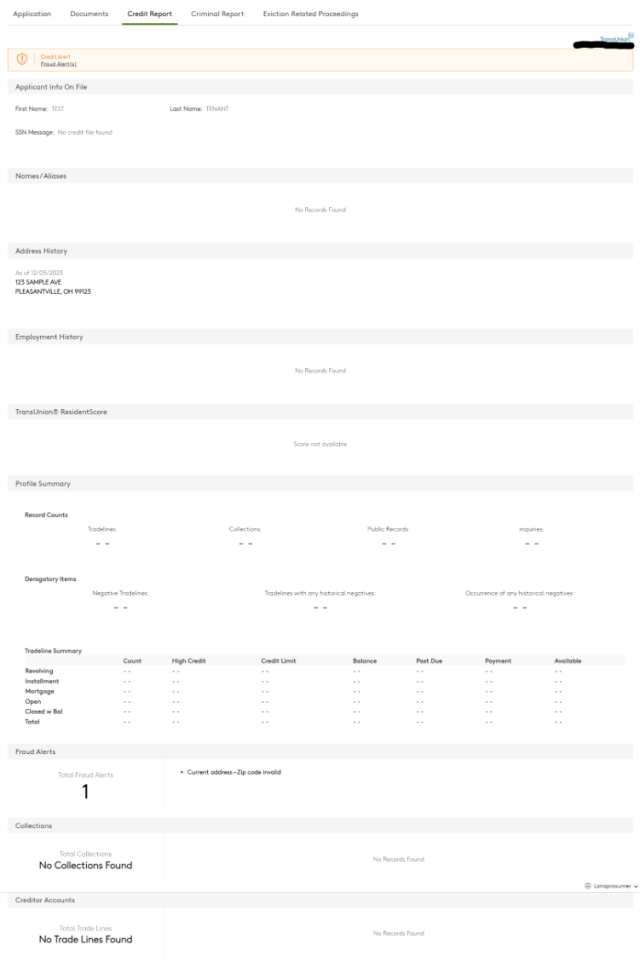

Apartments.com's online tenant screening platform lets you view the most important pieces of a renter's history in seconds, starting with a credit check. When diving into a tenant's credit report, you look at the backbone of their financial story. You'll first see basic information, such as their name and current address. You'll also see a detailed rundown of their payment history, any fraud indicators, and a tradeline summary of all active accounts (lines of credit, student loans, etc.).

The credit score itself is a number that represents a renter's financial responsibility. A low credit score may be associated with late payments, high debt, or inconsistent usage. The credit score focuses on their fiscal habits– it's a numerical snapshot of creditworthiness. Digging deeper, you'll assess their debt levels. High debt with inconsistent income could wave a red flag that they might struggle with the rent down the line. Don't overlook bankruptcies and collections either, as these could indicate some serious financial hurdles in the past.

Employment verification

While this information is not always contained within a credit report, Apartments.com bundles it into one concise document. Employment verification is like confirming the engine behind the applicant's ability to pay rent. You'll ensure their job (and its salary) is legitimate. Employment history also tells you if they have a history of steady jobs or consistent, long unemployment gaps.

ResidentScore

In addition to a credit report, Apartments.com provides a ResidentScore through TransUnion for each tenant you screen. The ResidentScore tool is built specifically for rental screenings to break down a renter's credit history and predict the likelihood of eviction. Additionally, this tool is especially useful for renters with a limited credit history since ResidentScore only needs one open account to conduct a thorough analysis. A ResidentScore provides more detailed information regarding:

- Payment history

- Credit utilization

- Credit history

- Credit availability

- Credit-seeking behavior

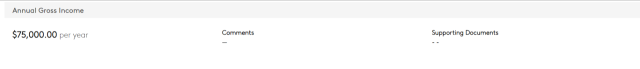

Proof of Income

By checking their salary details, you're ensuring a tenant is qualified and able to rent your property. Ideally, their income should be three times the rent, giving them room to breathe and assuring you that they can cover payments. Our online platform lets a tenant self-report income for a quick overview. From there, you can request supporting documents for proof of income, such as pay stubs, tax returns, or bank statements, which renters can upload directly to your online portal.

Criminal history

Criminal history is a sensitive but crucial part of tenant background screening. You've got to ensure your property and its residents are safe, so you'll check for any felonies, misdemeanors, or major offenses.

When running a criminal background check for a potential tenant, it's critical to remember that context is everything–not all past mistakes should disqualify a candidate. Remember to stay within the legal limits and use this information reasonably concerning privacy laws. You're not just checking boxes; you're ensuring the community stays secure while giving everyone a fair shot at housing.

Rental and Eviction History

Rental history and eviction records give you the most valuable insight on how a tenant will most likely act in your rental. If you see a repeated history of broken leases, property damage, or late payments, let the alarm bells sound.

The most concerning spot on a background check might be a past eviction, which can cost landlords thousands of dollars. Whether or not you see something concerning, it's a good idea to talk with previous landlords to get a firsthand account of tenant suitability.

References are a great resource, offering personal insights into the tenant's character. Ask the right questions – think about responsibility, behavior, and trustworthiness – and you'll better understand who the renter is. With Apartments.com, you get a high-level overview of your tenant's rental history, as well as detailed information for each category, to help you make the best decision for your business. Should you request reference letters from past landlords, these letters can be uploaded as supporting documents.

Legal Regulations of a Tenant Background Check

Tenant background checks are subject to various legal regulations at the federal, state, and local levels. These regulations are designed to protect both tenants' rights and landlords' interests, ensuring fair and nondiscriminatory tenant screening services and practices. As a landlord, you must adhere to these regulations to avoid legal liabilities and discrimination claims. Here are some key aspects of the legal regulations governing tenant background checks:

Adhere to fair housing laws

Sticking to fair housing laws isn't just good practice—it's your legal compass as a landlord. No matter who they are or where they come from, it's your legal obligation to give everyone fair consideration. When you're reviewing rental tenant applications, keep your process consistent for each applicant; it's not only fair, but it keeps you clear of legal hot water.

In the case that you get two near-identical applications, but one has a spotty rental history, fair housing laws don't stop you from choosing the stronger applicant based on legitimate factors. Remember, you're judging by their suitability to rent, not external factors.

Get written consent first

Before you dive into anyone's background, you need their go-ahead in black and white. It's simple: no signature, no screening. Get written consent that spells out what checks you're running and why. This way, they know what they're agreeing to, and you're covered legally. Make sure this step isn't buried in fine print; you want it clear as day so there's no confusion down the line. Plus, having this in your files is helpful if anyone questions your process later.

Disclose tenants' rights under the Fair Credit Reporting Act

Under the Fair Credit Reporting Act (FCRA), renters are entitled to know if anything in their credit report is being considered against them, allowing them to dispute inaccuracies. You're giving them the opportunity to make sure their report is truly representative of their history. Additionally, assure your tenant that you cannot share credit reports with parties other than those with a “permissible purpose.” This means that this specific report cannot be seen by anyone other than the landlord and tenant, protecting the renter from a breach of privacy.

Provide an adverse action notice

If anything on a renter's background screening is significant enough for you to deny them tenancy, you should let the applicant know with an adverse action notice. Be transparent with your reasoning and provide specific but professional details. An adverse action notice, however, is not always a rejection. Suppose a tenant is just becoming financially independent or is coming out of financial hardship. In that case, an adverse action notice can serve as a notice that the renter must have a co-signer or guarantor on their lease agreement or put down a higher security deposit before securing the rental.

An adverse action notice can be given orally, electronically, or in writing. An adverse action letter might look like:

[Applicant’s Name]

[Applicant’s Address]

Dear [Applicant’s Name]

Thank you for your recent application to [Property Name]. Unfortunately, we are currently unable to accept your application for the following reason(s):

Credit score does not meet minimum

Unable to verify income

Excessive debt compared to income

Irregular employment

Insufficient credit history

Please Note: If your application has been rejected due to insufficient credit, you have the right under the Fair Credit Reporting Act to request a free credit report through [Screening Service Used] or dispute inaccuracies.

To dispute or appeal this decision, please contact [Owner’s Name] by email at [Owner’s Email], by phone at [Owner’s Phone Number], or by sending a written letter to [Owner’s Address] within [Number of Days] of receiving this notice.

If you'd like to add on an appeal (such as a required co-signer), you should do so before the letter's conclusion. Make sure to mention the legal rights this applicant is granted by the government, including the previously mentioned Fair Credit Reporting Act.

What are the benefits of tenant background checks?

-

Peace of Mind: Tenant background checks help you zero in on reliable renters who won't just pay their rent on time but will also treat your property respectfully. By doing the work upfront, you're more likely to avoid the headache of late payments and the hassle of constant repairs down the road.

-

Tenant Satisfaction: When you run background checks, you're taking the first step toward creating a safe and harmonious environment for everyone. You'll know that the people moving in don't have a history of causing trouble or jeopardizing the safety of others, preventing current, reliable tenants from moving out because of others' bad behavior.

-

Decreased Turnover: By screening a tenant for a complete rental history, you will likely find steady and consistent renters. Long-term tenants mean you're not constantly looking for new renters, and that consistency helps keep the revenue rolling.

-

Proactive Rental Protection: Your rental property is your business. Make sure your renters treat it that way. With a thorough background check, you're putting up your best defense against unforeseen chaos and property damage. You're checking that they've treated past properties carefully, which suggests they'll do the same for yours.

-

Legal Protection: Lastly, conducting background checks helps you comply with the law. Judging every applicant on the same stringent qualifications ensures everyone is treated fairly and consistently, reducing the risk of discrimination claims.

Common Challenges

-

Accuracy: One of the stickier issues you might encounter with tenant background checks is the accuracy of the information you're digging up. Sometimes, reports can have mistakes or outdated information that doesn't fairly represent the applicant's current situation. This is why allowing the applicant to dispute outdated information is so crucial.

-

Addressing the right concerns: No applicant is perfect. While you may be tempted to deny any application that comes back imperfect, remember that not every blemish on a background check indicates a poor renter. Have conversations and request references to understand the full potential of each applicant.

-

Privacy: Privacy concerns are another real challenge when conducting background checks. Applicants are handing over personal info and trusting you to handle it tactfully. If you're not careful, you could end up with a security breach or a privacy complaint. Always consult your local laws before sharing any information with other parties.

-

Cost: Lastly, thorough background checks can add up quickly. A rental screening can cost anywhere between $15-$40. Don't cut corners, but do prioritize screening tenants who are serious about their inquiries and meet high-level qualifications (think self-reported income and immediate availability).

A tenant background check is your first defense in safeguarding your property and maintaining your investment. Remember that investing time and effort into comprehensive tenant screening pays off down the road. While they come with their own set of stipulations, don't skip this step! Take advantage of all our available resources to help you fill your vacancy. It's a crucial step that helps you build the strong foundation your rental business needs to succeed.

This article is for informational purposes only. This resource is not a substitute for the legal advice of an attorney, nor is it guaranteed to comply with current or local laws. For advice regarding your specific situation, consult a licensed attorney in your area.