What are the top concerns and objectives for multifamily marketers today? When advertising their properties, multifamily owners and operators weigh a variety of considerations, including effectiveness, budget, and target audience.

A new survey offers a closer look at how properties like yours are advertising in 2024.

The survey examined the key trends in multifamily marketing today. Representing approximately 18,000 communities and over 1.5 million units, the survey respondents explored marketing decisions, tools, and budget.

Let’s dive into the data.

Top marketing goals

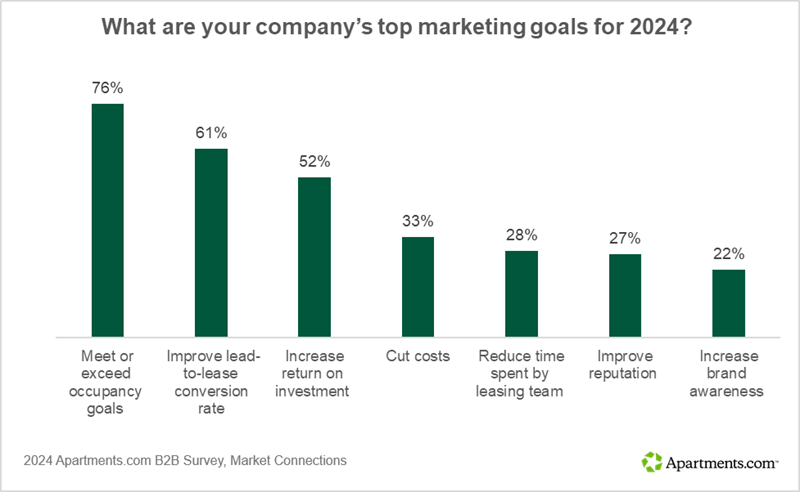

Occupancy and conversion topped the list for 2024 marketing goals. Over three-quarters of decision-makers reported that meeting or exceeding occupancy goals was among their top three marketing priorities for the year, while 61 percent said the same for improving their lead-to-lease conversion rate.

Increasing return on investment was a top marketing goal for over half of respondents (52 percent). As one property manager put it, “We're looking to see a ROI that makes sense. We run the cost per lease on each ILS vendor to determine who does best for us.”

Facing inflation and a challenging economic climate for multifamily, a third of respondents cited cutting costs as a top goal (33 percent).

What other marketing priorities are on decision-makers’ roadmaps for this year? Other top goals included reducing the time spent by leasing teams (28 percent), improving reputation (27 percent), and increasing brand awareness (22 percent).

Top operational concerns

From leads to reputation, multifamily professionals shared their top operational concerns. Low-quality leads were the biggest concern, ranked in the top three for 72 percent of respondents.

To address this issue, one marketing leader described a new strategy for 2024: “I will be eliminating sources that don’t yield leases and will focus on quality leads.”

The majority of decision-makers also reported that high vacancy and low or negative rent growth were among their top concerns, reflecting stagnating market trends marked by limited rent growth and decades-high vacancy rates.

One marketer explained:

“The market for rental units has softened a great deal post-pandemic and therefore obtaining good leads and converting those leads to tenants has been much more difficult. Vacancies across the entire city have risen.”

Related to high vacancies, about a third of respondents reported low resident retention as a top concern (33 percent). As leasing teams take on more responsibilities, nearly a third of respondents (32 percent) selected limited staff bandwidth a top concern.

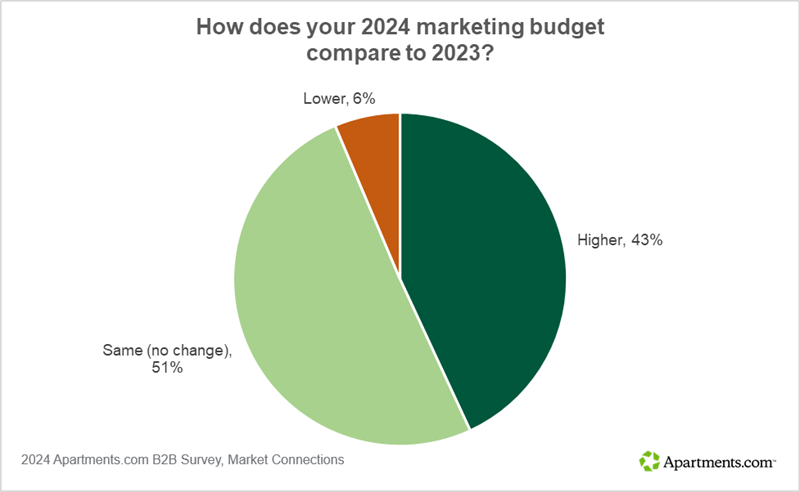

Financial concerns were a top operational issue for a quarter of respondents, with 23 percent citing insufficient budget. This comes during a challenging financial environment. Overall, a majority of multifamily decision-makers reported no increase in their marketing budget. One regional manager explained the difficult balance required: “I want to stay under budget but also have a large marketing presence.”

One in four identified brand and reputational issues as a main concern. These respondents described struggling to rebrand negatively perceived properties and improve the resident experience.

Biggest marketing challenges and strategic considerations

What obstacles do multifamily marketers face in 2024? Cited by a third of respondents, concerns about lead quality and lead conversion were the most common response to this open-ended question about marketing challenges.

As one property manager put it:

“Obtaining solid leads. So many just ask if the property is still available and they won’t actually make an appointment or apply.”

Other common concerns included marketing costs, advertising effectiveness, economics, and rental pricing.

How do these challenges translate to advertising strategy? We asked survey participants for their top considerations when developing their advertising strategy. Nearly a third mentioned cost considerations, such as these comments about cost effectiveness:

- “Really diving into what works and what doesn’t so that we can maximize our budget.”

- “Return for dollars spent”

- “We track the effectiveness of marketing dollars (who provides the most leads, the lead-to-lease conversion ratio, and cost per lead and per lease). Based on those factors, we allocate our marketing dollars.”

Another quarter of respondents highlighted their need for quality leads, including concerns like these:

- “Getting real people who are interested.”

- “Getting quality leads. Trying to avoid those options that produce multiple leads that don’t follow through.”

The outcomes that matter most — and least

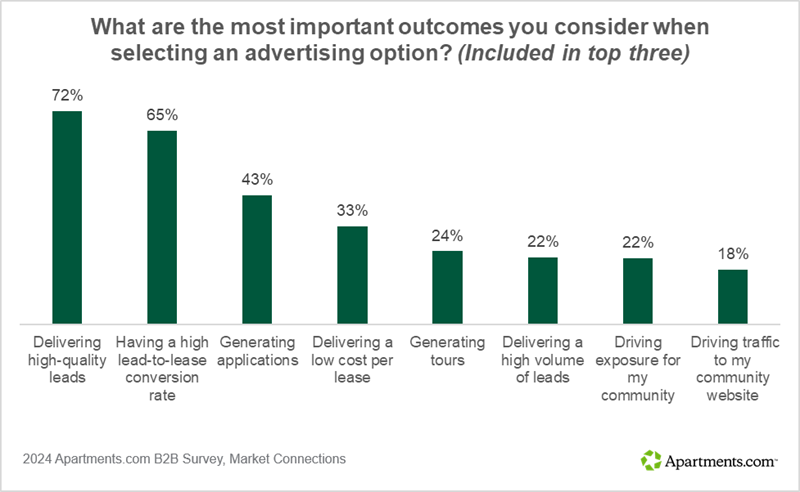

When advertising a property, multifamily decision-makers look at a range of data, including leads generated, tours scheduled, and applications submitted. But not all outcomes carry the same weight. Delivering high-quality leads was selected by nearly three-quarters of respondents as a top priority.

Close behind was a high lead-to-lease conversion rate, selected by 65 percent of respondents as one of their top priorities.

Quality and conversion outranked outcomes like generating applications (43 percent) and delivering a low cost per lease (33 percent). Quantity doesn’t necessary translate to quality, respondents explained. One property owner described the challenge of finding an advertising source that “brings in actual units rented, not just applicants.”

Selected by less than a quarter of respondents, the outcomes at the bottom of the list were driving community website traffic (18 percent), community exposure (22 percent), a high volume of leads (22 percent), and generating tours (24 percent) — all metrics less closely tied to lease generation.

How budgets and marketing spend have shifted

Despite rising costs due to inflation, half of respondents reported no change in their marketing budget. Only 6 percent said their budget had decreased compared to 2023, while 43 percent reported an increased budget for 2024.

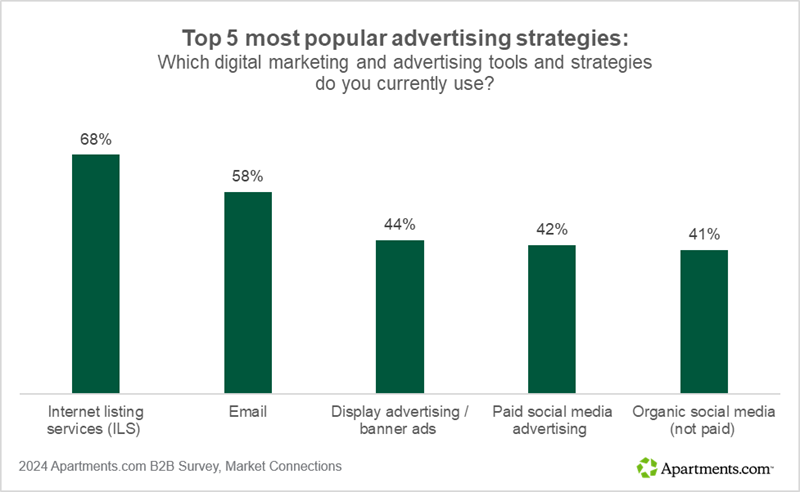

When allocating that budget, which tools do multifamily marketers rely on? The majority of respondents cited internet listing services, with 68 percent reporting that they currently use an ILS. The second-most popular strategy was email, used by 58 percent of respondents.

Fewer than half of respondents rely on display and banner ads (44 percent), paid and organic social media advertising (42 percent and 41 percent, respectively), search engine optimization (40 percent), and pay-per-click advertising (35 percent).

Less than a third of respondents use approaches like online video (29 percent), SMS- or text-based marketing (25 percent), geofencing (21 percent), and AI-generated marketing (13 percent).

Get personalized help with your advertising strategy

Looking to optimize your marketing strategy? Talk to an Apartments.com sales associate to learn what advertising options are right for your properties’ needs and goals.

Looking for more advertising insights?

Explore these helpful resources: